Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies accesso Technology Group plc (LON:ACSO) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for accesso Technology Group

What Is accesso Technology Group's Debt?

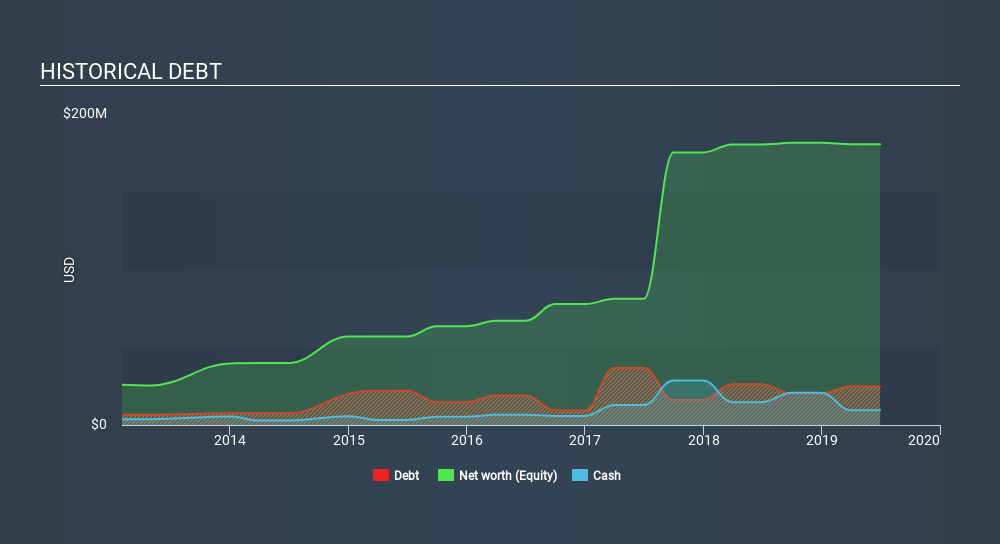

As you can see below, at the end of June 2019, accesso Technology Group had US$24.8m of debt, up from US$26.2 a year ago. Click the image for more detail. On the flip side, it has US$9.54m in cash leading to net debt of about US$15.2m.

How Strong Is accesso Technology Group's Balance Sheet?

According to the last reported balance sheet, accesso Technology Group had liabilities of US$28.9m due within 12 months, and liabilities of US$46.8m due beyond 12 months. On the other hand, it had cash of US$9.54m and US$28.8m worth of receivables due within a year. So its liabilities total US$37.4m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because accesso Technology Group is worth US$179.5m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

accesso Technology Group's net debt to EBITDA ratio of about 1.7 suggests only moderate use of debt. And its commanding EBIT of 10.6 times its interest expense, implies the debt load is as light as a peacock feather. Importantly, accesso Technology Group's EBIT fell a jaw-dropping 59% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for accesso Technology Group which any shareholder or potential investor should be aware of.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, accesso Technology Group's free cash flow amounted to 34% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

accesso Technology Group's struggle to grow its EBIT had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. In particular, its interest cover was re-invigorating. We think that accesso Technology Group's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:ACSO

accesso Technology Group

Develops technology solutions for the attractions and leisure industry.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives