As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term WPX Energy, Inc. (NYSE:WPX) shareholders have had that experience, with the share price dropping 26% in three years, versus a market return of about 46%. On the other hand the share price has bounced 5.7% over the last week.

Check out our latest analysis for WPX Energy

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, WPX Energy moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We note that, in three years, revenue has actually grown at a 44% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating WPX Energy further; while we may be missing something on this analysis, there might also be an opportunity.

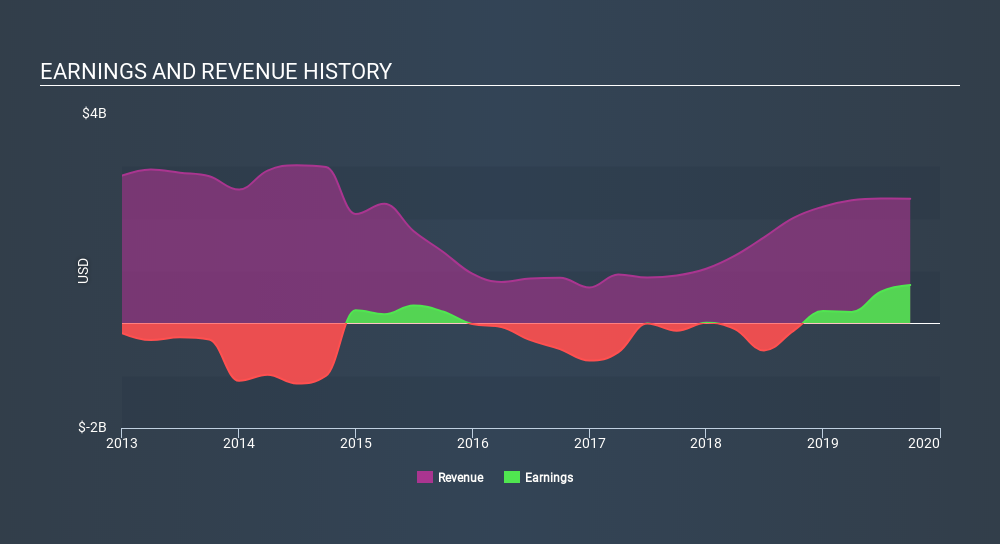

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 4 warning signs for WPX Energy (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

Investors in WPX Energy had a tough year, with a total loss of 17%, against a market gain of about 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.1% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on WPX Energy it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives