- Hong Kong

- /

- Capital Markets

- /

- SEHK:821

Investors Who Bought Value Convergence Holdings (HKG:821) Shares Five Years Ago Are Now Down 86%

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Anyone who held Value Convergence Holdings Limited (HKG:821) for five years would be nursing their metaphorical wounds since the share price dropped 86% in that time. And some of the more recent buyers are probably worried, too, with the stock falling 57% in the last year. Furthermore, it's down 19% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 8.1% in the same period.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Value Convergence Holdings

Value Convergence Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Value Convergence Holdings reduced its trailing twelve month revenue by 18% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 33% per year in the same time period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

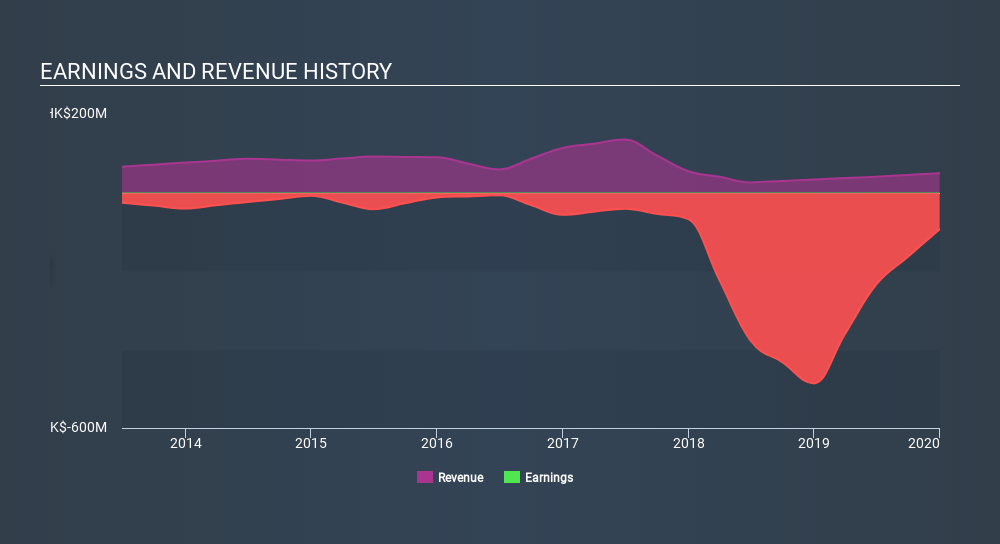

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Value Convergence Holdings's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Value Convergence Holdings shareholders are down 57% for the year. Unfortunately, that's worse than the broader market decline of 4.8%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 33% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Value Convergence Holdings better, we need to consider many other factors. For example, we've discovered 2 warning signs for Value Convergence Holdings (1 is significant!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:821

Value Convergence Holdings

An investment holding company, provides financial services in Hong Kong.

Excellent balance sheet low.

Market Insights

Community Narratives