- Poland

- /

- Professional Services

- /

- WSE:TXN

Investors Who Bought Tax-Net (WSE:TXN) Shares Three Years Ago Are Now Up 49%

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, the Tax-Net S.A. (WSE:TXN) share price is up 49% in the last three years, clearly besting the market return of around 7.5% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 24%.

View our latest analysis for Tax-Net

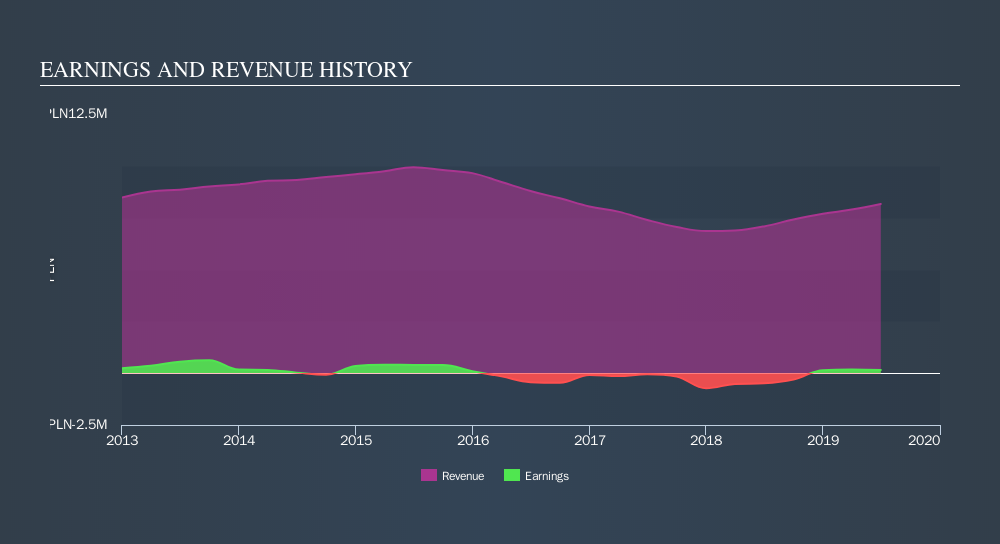

Given that Tax-Net only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Tax-Net actually saw its revenue drop by 2.8% per year over three years. Despite the lack of revenue growth, the stock has returned 14%, compound, over three years. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Tax-Net's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Tax-Net shareholders have received a total shareholder return of 24% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.6% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before deciding if you like the current share price, check how Tax-Net scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:TXN

Tax-Net

Provides accounting and tax financial advisory services in Poland.

Flawless balance sheet medium-low and pays a dividend.

Market Insights

Community Narratives