- United States

- /

- Oil and Gas

- /

- NYSE:INSW

Investors Who Bought International Seaways (NYSE:INSW) Shares A Year Ago Are Now Down 16%

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the International Seaways, Inc. (NYSE:INSW) share price slid 16% over twelve months. That's disappointing when you consider the market returned 0.9%. International Seaways may have better days ahead, of course; we've only looked at a one year period. It's up 2.3% in the last seven days.

See our latest analysis for International Seaways

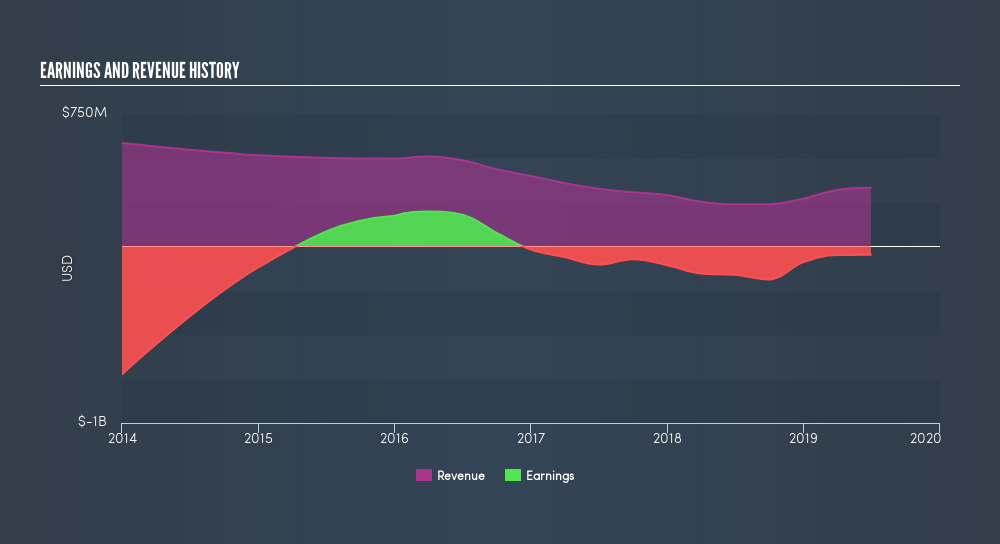

International Seaways isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

International Seaways grew its revenue by 39% over the last year. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 16%. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

Take a more thorough look at International Seaways's financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 0.9% in the last year, International Seaways shareholders might be miffed that they lost 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 5.9% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before spending more time on International Seaways it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:INSW

International Seaways

Owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives