- United States

- /

- Biotech

- /

- NasdaqGS:CCXI

Investors Who Bought ChemoCentryx (NASDAQ:CCXI) Shares Five Years Ago Are Now Up 459%

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the ChemoCentryx, Inc. (NASDAQ:CCXI) share price is up a whopping 459% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 356% gain in the last three months.

See our latest analysis for ChemoCentryx

Given that ChemoCentryx didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years ChemoCentryx saw its revenue grow at 34% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 41% per year in that time. Despite the strong run, top performers like ChemoCentryx have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

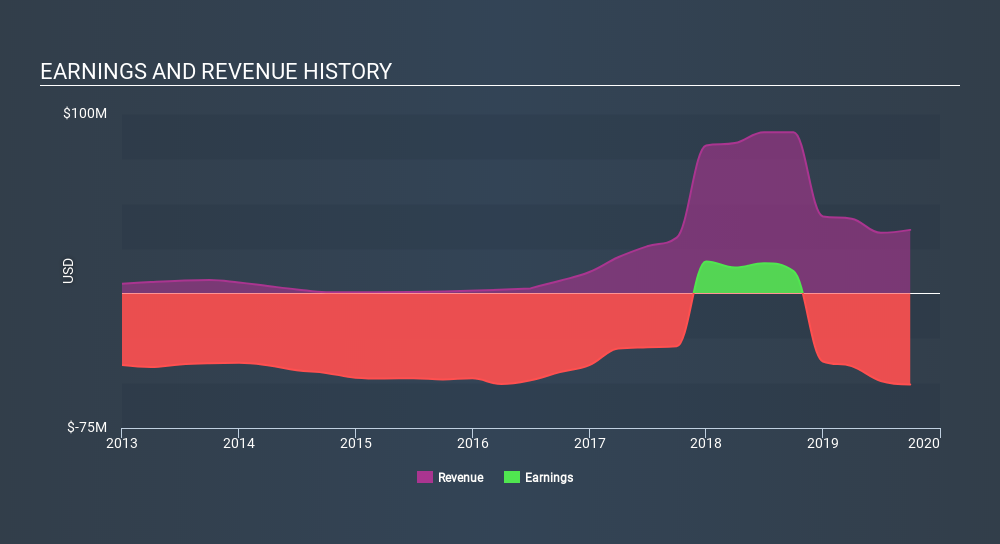

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on ChemoCentryx's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that ChemoCentryx shareholders have received a total shareholder return of 218% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 41% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CCXI

ChemoCentryx

ChemoCentryx, Inc., a biopharmaceutical company, focuses on the development and commercialization of new medications for inflammatory disorders, autoimmune diseases, and cancer in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives