- Switzerland

- /

- Capital Markets

- /

- SWX:VPBN

Introducing VP Bank (VTX:VPBN), The Stock That Zoomed 115% In The Last Five Years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. Long term VP Bank AG (VTX:VPBN) shareholders would be well aware of this, since the stock is up 115% in five years.

View our latest analysis for VP Bank

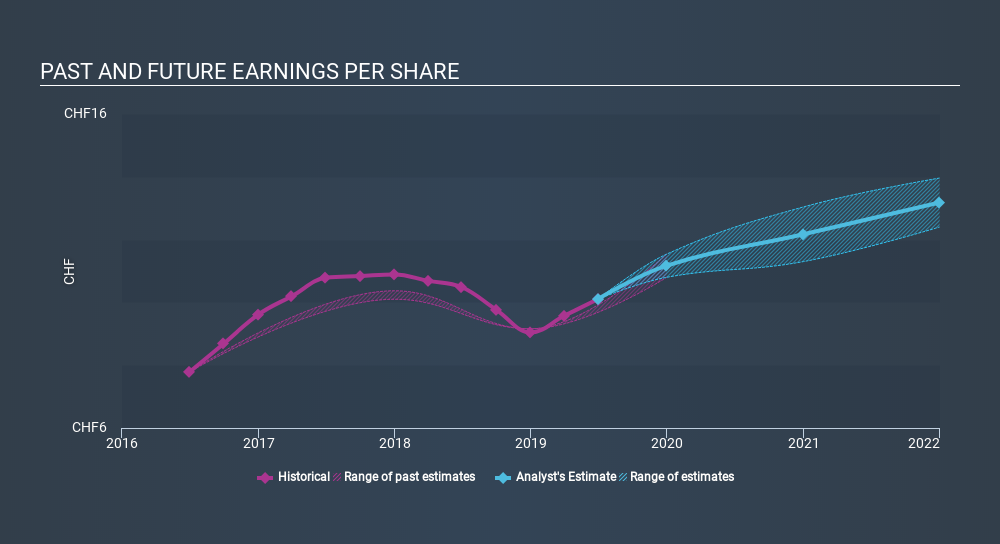

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, VP Bank managed to grow its earnings per share at 24% a year. This EPS growth is higher than the 17% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on VP Bank's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, VP Bank's TSR for the last 5 years was 160%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

VP Bank shareholders have received returns of 24% over twelve months (even including dividends) , which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 21%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It's always interesting to track share price performance over the longer term. But to understand VP Bank better, we need to consider many other factors. For example, we've discovered 1 warning sign for VP Bank that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SWX:VPBN

VP Bank

Provides wealth management and investment advisory services for private and institutional investors in Liechtenstein, rest of Europe, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives