- United States

- /

- Renewable Energy

- /

- NasdaqCM:VVPR

Introducing VivoPower International (NASDAQ:VVPR), The Stock That Tanked 74%

VivoPower International PLC (NASDAQ:VVPR) shareholders should be happy to see the share price up 10% in the last month. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 74% in that time. Arguably, the recent bounce is to be expected after such a bad drop. But the more important question is whether the underlying business can justify a higher price still.

See our latest analysis for VivoPower International

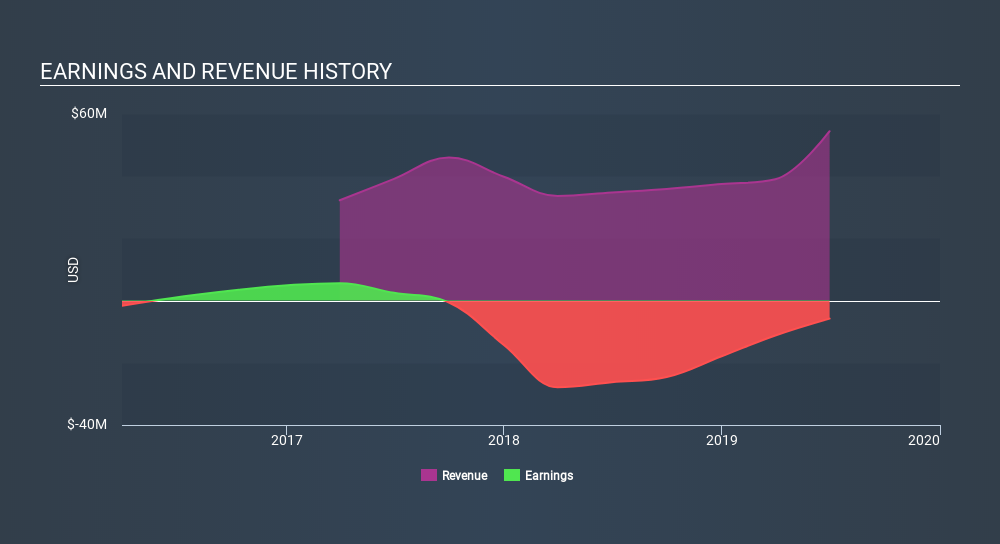

VivoPower International wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of VivoPower International's earnings, revenue and cash flow.

A Different Perspective

Over the last year VivoPower International shareholders have received a TSR of 20%. Unfortunately this falls short of the market return of around 23%. The silver lining is that the recent rise is far preferable to the annual loss of 36% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for VivoPower International (of which 1 shouldn't be ignored!) you should know about.

We will like VivoPower International better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:VVPR

VivoPower International

Provides energy solutions for customized and ruggedized fleet applications, battery and microgrids, and solar and critical power technology and services.

Medium-low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives