- Hong Kong

- /

- Electrical

- /

- SEHK:1750

Introducing REM Group (Holdings) (HKG:1750), The Stock That Slid 65% In The Last Year

Even the best stock pickers will make plenty of bad investments. Unfortunately, shareholders of REM Group (Holdings) Limited (HKG:1750) have suffered share price declines over the last year. The share price has slid 65% in that time. REM Group (Holdings) hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The falls have accelerated recently, with the share price down 19% in the last three months.

View our latest analysis for REM Group (Holdings)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the REM Group (Holdings) share price fell, it actually saw its earnings per share (EPS) improve by 4.8%. Of course, the situation might betray previous over-optimism about growth.

It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

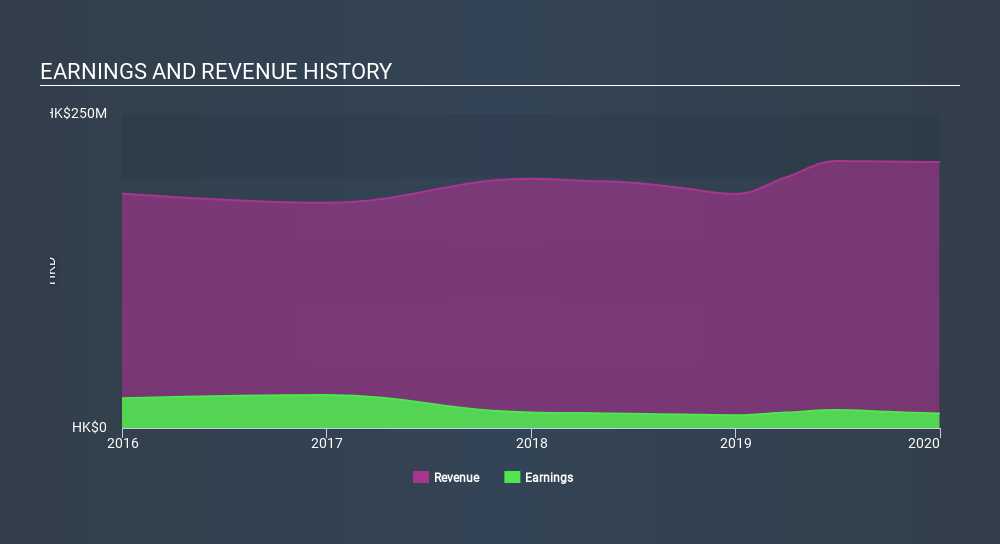

REM Group (Holdings)'s revenue is actually up 14% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on REM Group (Holdings)'s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

REM Group (Holdings) shareholders are down 65% for the year, even worse than the market loss of 1.9%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 19%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand REM Group (Holdings) better, we need to consider many other factors. Take risks, for example - REM Group (Holdings) has 4 warning signs (and 2 which are concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:1750

REM Group (Holdings)

An investment holding company, engages in the manufacture and sale of low-voltage electrical power distribution and control devices in Hong Kong, Macau, and the Mainland China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives