Introducing Powerful Technologies (NSE:POWERFUL), The Stock That Tanked 79%

Powerful Technologies Limited (NSE:POWERFUL) shareholders should be happy to see the share price up 19% in the last month. But that doesn't change the fact that the returns over the last year have been stomach churning. During that time the share price has plummeted like a stone, down 79%. So it's not that amazing to see a bit of a bounce. The bigger issue is whether the company can sustain the momentum in the long term.

See our latest analysis for Powerful Technologies

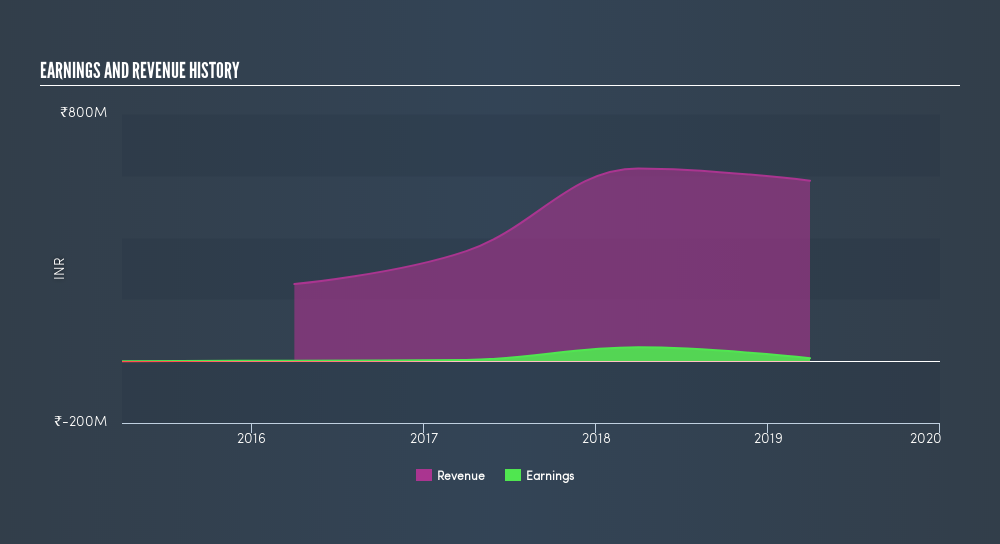

We don't think that Powerful Technologies's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In just one year Powerful Technologies saw its revenue fall by 6.4%. That's not what investors generally want to see. The market obviously agrees, since the share price tanked 79%. Holders should not lose the lesson: loss making companies should grow revenue. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We doubt Powerful Technologies shareholders are happy with the loss of 79% over twelve months. That falls short of the market, which lost 12%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 31%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before forming an opinion on Powerful Technologies you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.