- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:439

Introducing KuangChi Science (HKG:439), The Stock That Tanked 95%

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held KuangChi Science Limited (HKG:439) for five whole years - as the share price tanked 95%. And some of the more recent buyers are probably worried, too, with the stock falling 54% in the last year. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for KuangChi Science

KuangChi Science wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, KuangChi Science grew its revenue at 2.9% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 44%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

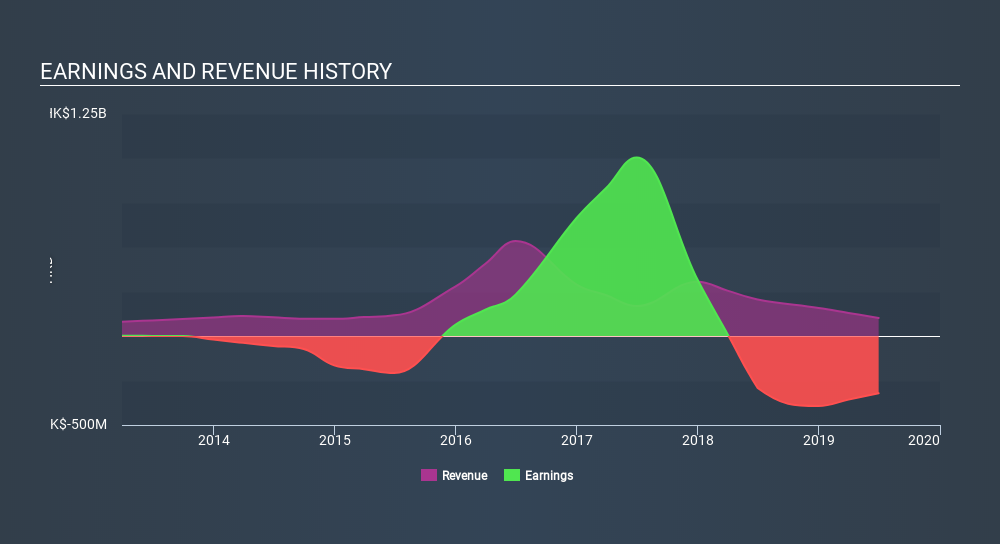

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at KuangChi Science's financial health with this free report on its balance sheet.

A Different Perspective

KuangChi Science shareholders are down 54% for the year, but the market itself is up 8.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 44% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with KuangChi Science (including 1 which is is a bit unpleasant) .

But note: KuangChi Science may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:439

KuangChi Science

An investment holding company, engages in the development of artificial intelligence (AI) technology and related products in the People’s Republic of China, Hong Kong, and internationally.

Excellent balance sheet very low.

Market Insights

Community Narratives