- Hong Kong

- /

- Hospitality

- /

- SEHK:1803

Introducing Beijing Sports and Entertainment Industry Group (HKG:1803), The Stock That Zoomed 213% In The Last Three Years

It hasn't been the best quarter for Beijing Sports and Entertainment Industry Group Limited (HKG:1803) shareholders, since the share price has fallen 12% in that time. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. Indeed, the share price is up a very strong 213% in that time. After a run like that some may not be surprised to see prices moderate. If the business can perform well for years to come, then the recent drop could be an opportunity.

See our latest analysis for Beijing Sports and Entertainment Industry Group

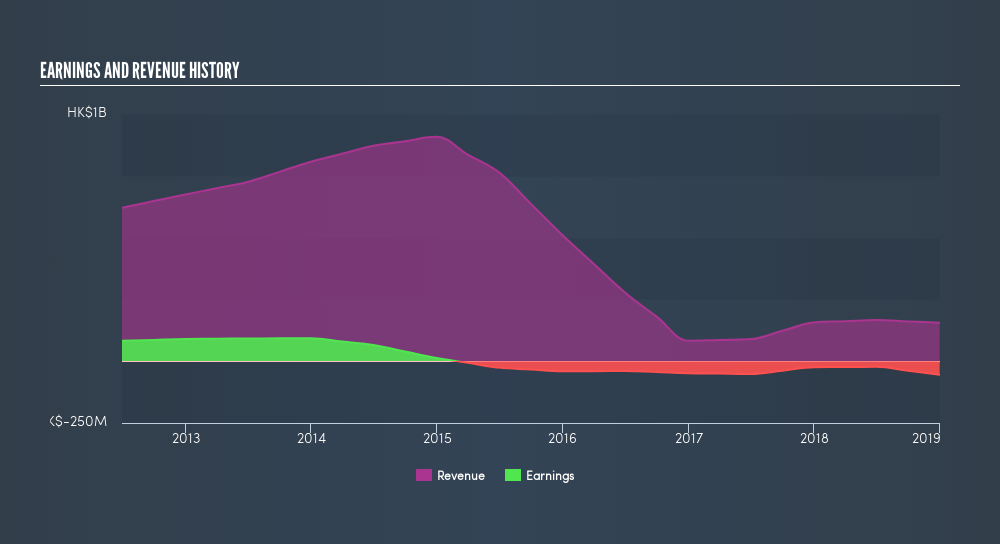

Beijing Sports and Entertainment Industry Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Beijing Sports and Entertainment Industry Group saw its revenue shrink by 41% per year. So the share price gain of 46% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Beijing Sports and Entertainment Industry Group's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Beijing Sports and Entertainment Industry Group shareholders, and that cash payout contributed to why its TSR of 213%, over the last 3 years, is better than the share price return.

A Different Perspective

While the broader market lost about 1.3% in the twelve months, Beijing Sports and Entertainment Industry Group shareholders did even worse, losing 23%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 18% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on Beijing Sports and Entertainment Industry Group it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1803

Beijing Sports and Entertainment Industry Group

An investment holding company, operates in the sports and entertainment related industry in Mainland China and Indonesia.

Excellent balance sheet low.

Market Insights

Community Narratives