Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Even the best stock pickers will make plenty of bad investments. Anyone who held Aminex PLC (LON:AEX) over the last year knows what a loser feels like. The share price is down a hefty 53% in that time. On the bright side, the stock is actually up 5.7% in the last three years. Even worse, it's down 19% in about a month, which is even more concerning.

See our latest analysis for Aminex

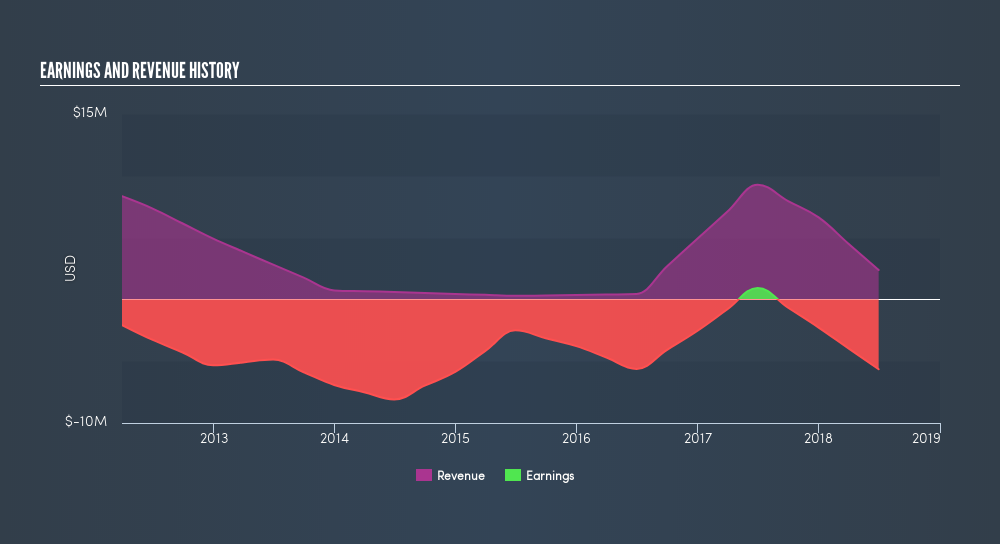

Given that Aminex didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Aminex's revenue didn't grow at all in the last year. In fact, it fell 74%. If you think that's a particularly bad result, you're statistically on the money Arguably, the market has responded appropriately to this performance by sending the share price down 53% in the same time period. Buying shares in companies that lose money, shrink revenue, and see share price declines is unpopular with investors, but popular with speculators (apparently). So we'll be looking for strong improvements on the numbers before getting excited.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

Investors in Aminex had a tough year, with a total loss of 53%, against a market gain of about 1.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 6.4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you would like to research Aminex in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:AEX

Aminex

Engages in the exploration, appraisal, development, and production of oil and gas assets, reserves, and resources.

Slight with worrying balance sheet.

Market Insights

Community Narratives