- United Kingdom

- /

- Airlines

- /

- LSE:IAG

International Consolidated Airlines Group, S.A. (LON:IAG) Analysts Just Cut Their EPS Forecasts By 40%

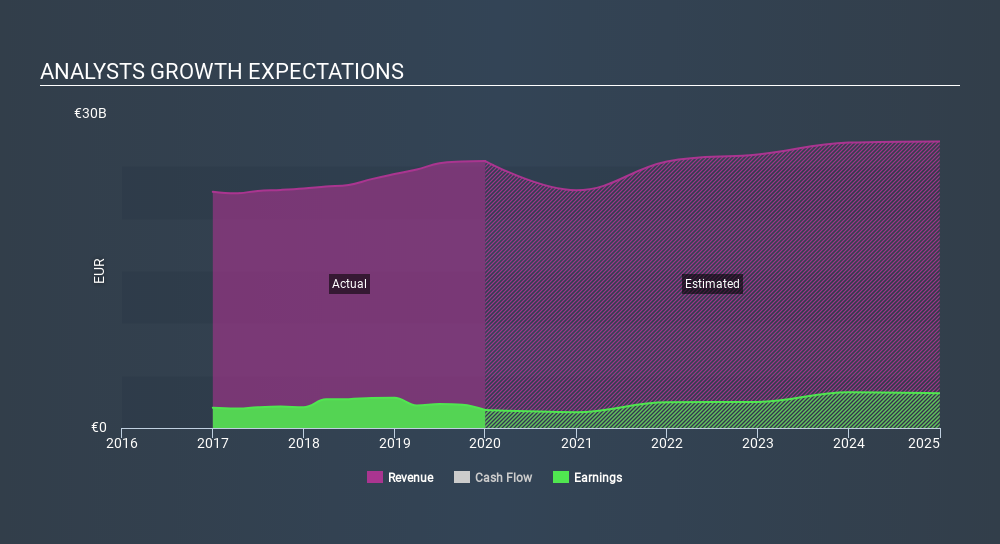

The analysts covering International Consolidated Airlines Group, S.A. (LON:IAG) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

After the downgrade, the consensus from International Consolidated Airlines Group's 24 analysts is for revenues of €23b in 2020, which would reflect a definite 11% decline in sales compared to the last year of performance. Statutory earnings per share are anticipated to crater 40% to €0.52 in the same period. Previously, the analysts had been modelling revenues of €25b and earnings per share (EPS) of €0.87 in 2020. The forecasts seem less optimistic after the new consensus numbers, with lower sales estimates and making a pretty serious decline to earnings per share forecasts.

See our latest analysis for International Consolidated Airlines Group

The consensus price target fell 8.3% to €6.65, with the weaker earnings outlook clearly leading analyst valuation estimates. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on International Consolidated Airlines Group, with the most bullish analyst valuing it at €8.78 and the most bearish at €5.21 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await International Consolidated Airlines Group shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the International Consolidated Airlines Group's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 11%, a significant reduction from annual growth of 3.6% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 5.8% next year. It's pretty clear that International Consolidated Airlines Group's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for International Consolidated Airlines Group. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that International Consolidated Airlines Group's revenues are expected to grow slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with International Consolidated Airlines Group's business, like a weak balance sheet. For more information, you can click here to discover this and the 4 other risks we've identified.

You can also see our analysis of International Consolidated Airlines Group's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:IAG

International Consolidated Airlines Group

Engages in the provision of passenger and cargo transportation services in the North Atlantic, Latin America, the Caribbean, Europe, Africa, the Middle East, South Asia, the Asia Pacific, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion