- United States

- /

- Medical Equipment

- /

- NasdaqCM:CTSO

Insider Buying: The Cytosorbents Corporation (NASDAQ:CTSO) CEO, President & Director Just Bought US$59k Worth Of Shares

Even if it's not a huge purchase, we think it was good to see that Phillip Chan, the CEO, President & Director of Cytosorbents Corporation (NASDAQ:CTSO) recently shelled out US$59k to buy stock, at US$3.60 per share. That might not be a big purchase but it only increased their holding by 4.5%, and could be interpreted as a good sign.

See our latest analysis for Cytosorbents

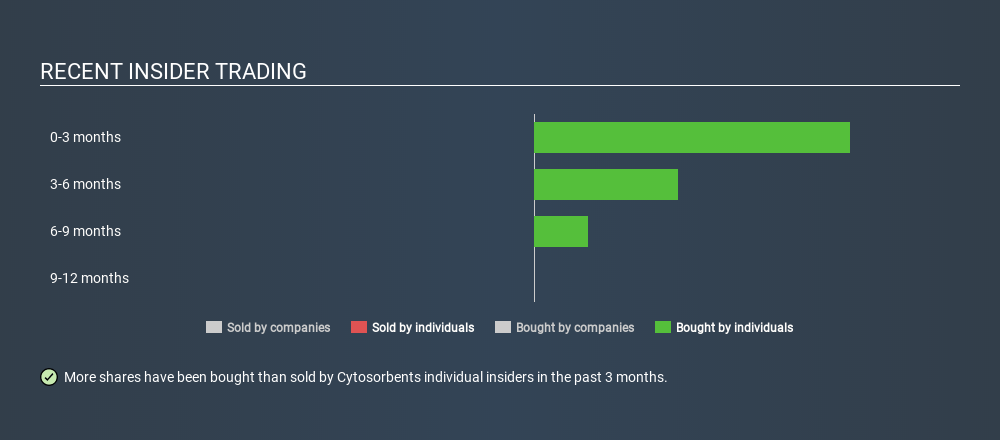

The Last 12 Months Of Insider Transactions At Cytosorbents

In fact, the recent purchase by Phillip Chan was the biggest purchase of Cytosorbents shares made by an insider individual in the last twelve months, according to our records. So it's clear an insider wanted to buy, at around the current price, which is US$3.81. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. In this case we're pleased to report that the insider purchases were made at close to current prices.

Cytosorbents insiders may have bought shares in the last year, but they didn't sell any. The average buy price was around US$4.31. This is nice to see since it implies that insiders might see value around current prices. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Cytosorbents is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It appears that Cytosorbents insiders own 11% of the company, worth about US$13m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The Cytosorbents Insider Transactions Indicate?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. But we don't feel the same about the fact the company is making losses. Insiders likely see value in Cytosorbents shares, given these transactions (along with notable insider ownership of the company). Of course, the future is what matters most. So if you are interested in Cytosorbents, you should check out this free report on analyst forecasts for the company.

But note: Cytosorbents may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:CTSO

Cytosorbents

Engages in the research, development, and commercialization of medical devices with its blood purification technology platform incorporating a proprietary adsorbent and porous polymer technology in the United States, Germany, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives