As we head into the second half of 2025, trade negotiations and tariff discussions between major economies like the U.S. and China are creating a complex backdrop for investors to navigate. Despite these challenges, penny stocks remain an intriguing area for those seeking opportunities in smaller or newer companies with strong financial foundations. While the term "penny stock" might seem outdated, these investments can still offer surprising value and potential for growth when backed by solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.70 | CA$631.14M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.31 | CA$706.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.50 | CA$191.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.80 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.24 | CA$93.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.09 | CA$122.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.92 | CA$182.11M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.88 | CA$5.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 885 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

InnoCan Pharma (CNSX:INNO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: InnoCan Pharma Corporation is a pharmaceutical technology company that develops drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients, operating in the United States, Canada, Europe, and internationally, with a market cap of CA$51.17 million.

Operations: InnoCan Pharma generates its revenue primarily through online sales, which account for $30.43 million, with a minor contribution from other operations at $0.034 million.

Market Cap: CA$51.17M

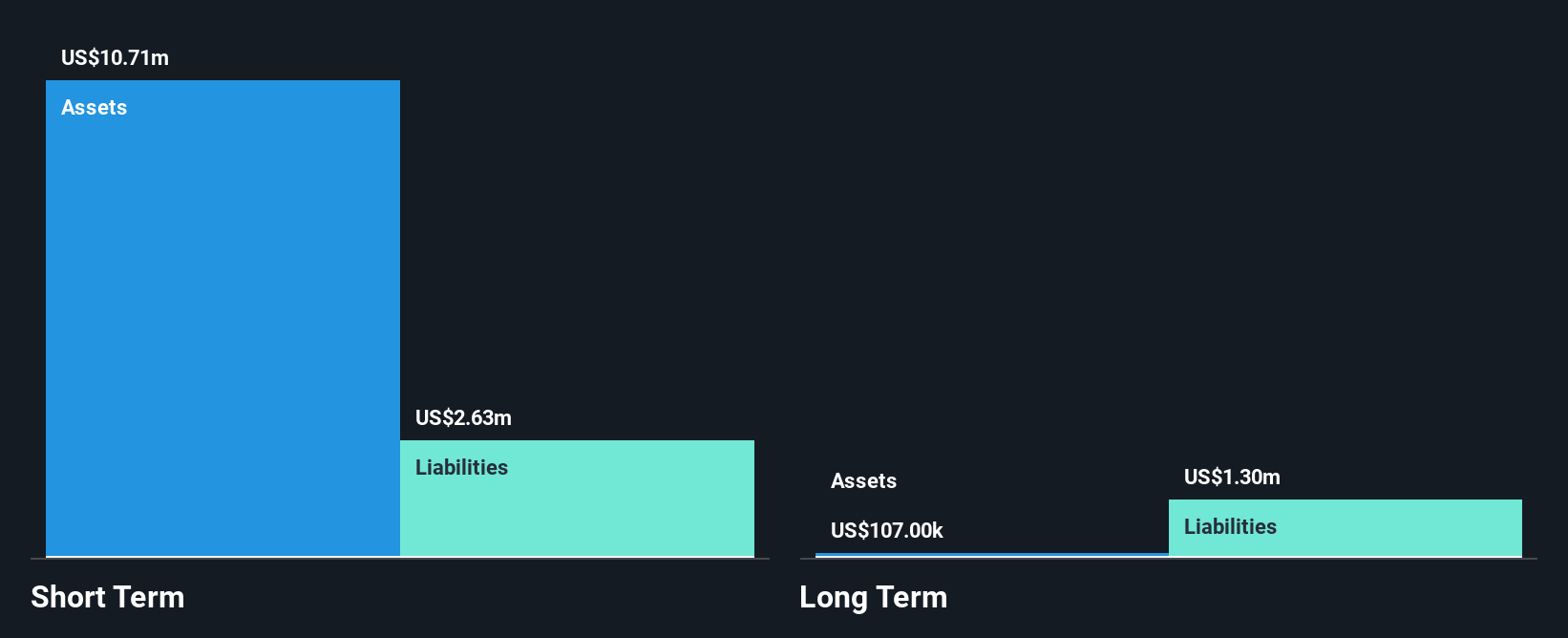

InnoCan Pharma, with a market cap of CA$51.17 million, is currently unprofitable but has shown progress by reducing losses over the past five years at a rate of 22.9% per year. The company reported Q1 2025 sales of US$7.8 million and reduced its net loss to US$0.582 million from US$1.77 million a year ago, indicating improved financial performance despite ongoing challenges such as auditor concerns about its ability to continue as a going concern. Recent patent approvals in Mexico and strategic moves in China enhance its intellectual property portfolio, potentially opening new markets for growth.

- Take a closer look at InnoCan Pharma's potential here in our financial health report.

- Explore historical data to track InnoCan Pharma's performance over time in our past results report.

Atha Energy (TSXV:SASK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atha Energy Corp. is a mineral company focused on acquiring, exploring, and evaluating mineral resources in Canada, with a market cap of CA$196.77 million.

Operations: Atha Energy Corp. has not reported any revenue segments.

Market Cap: CA$196.77M

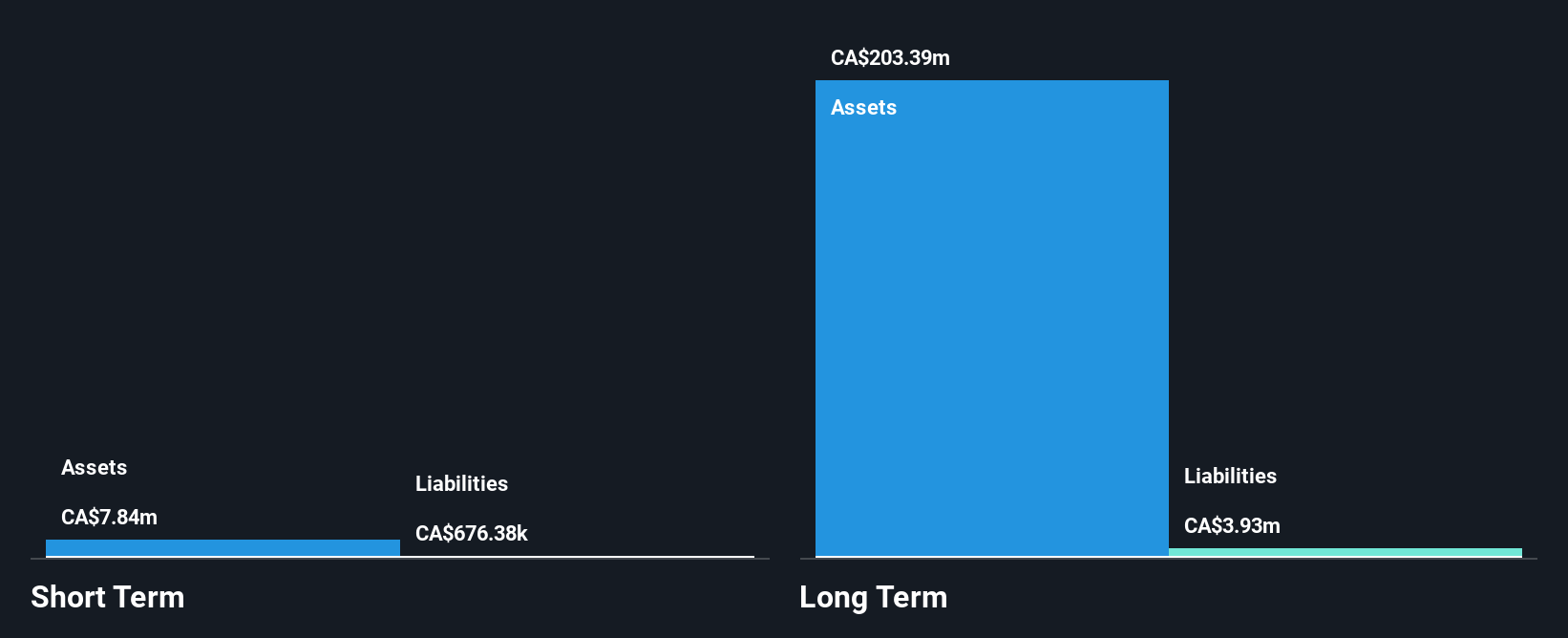

Atha Energy Corp., with a market cap of CA$196.77 million, is pre-revenue and currently unprofitable, having reported a net loss of CA$1.79 million for Q1 2025. The company has recently initiated its 2025 diamond drill exploration program at the Angilak Uranium Project, targeting high-grade uranium along the Rib-Nine Iron Trend in Nunavut. This follows successful past drilling campaigns that intersected significant uranium mineralization. Recent board changes bring experienced leadership in uranium exploration, potentially enhancing strategic direction despite auditor concerns about its ability to continue as a going concern. A recent capital raise of CA$10 million aims to support ongoing operations and exploration activities.

- Navigate through the intricacies of Atha Energy with our comprehensive balance sheet health report here.

- Gain insights into Atha Energy's future direction by reviewing our growth report.

Northern Superior Resources (TSXV:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Superior Resources Inc. is a junior mining company focused on exploring and developing gold properties in Ontario and Québec, Canada, with a market cap of CA$139.19 million.

Operations: Northern Superior Resources Inc. has not reported any revenue segments.

Market Cap: CA$139.19M

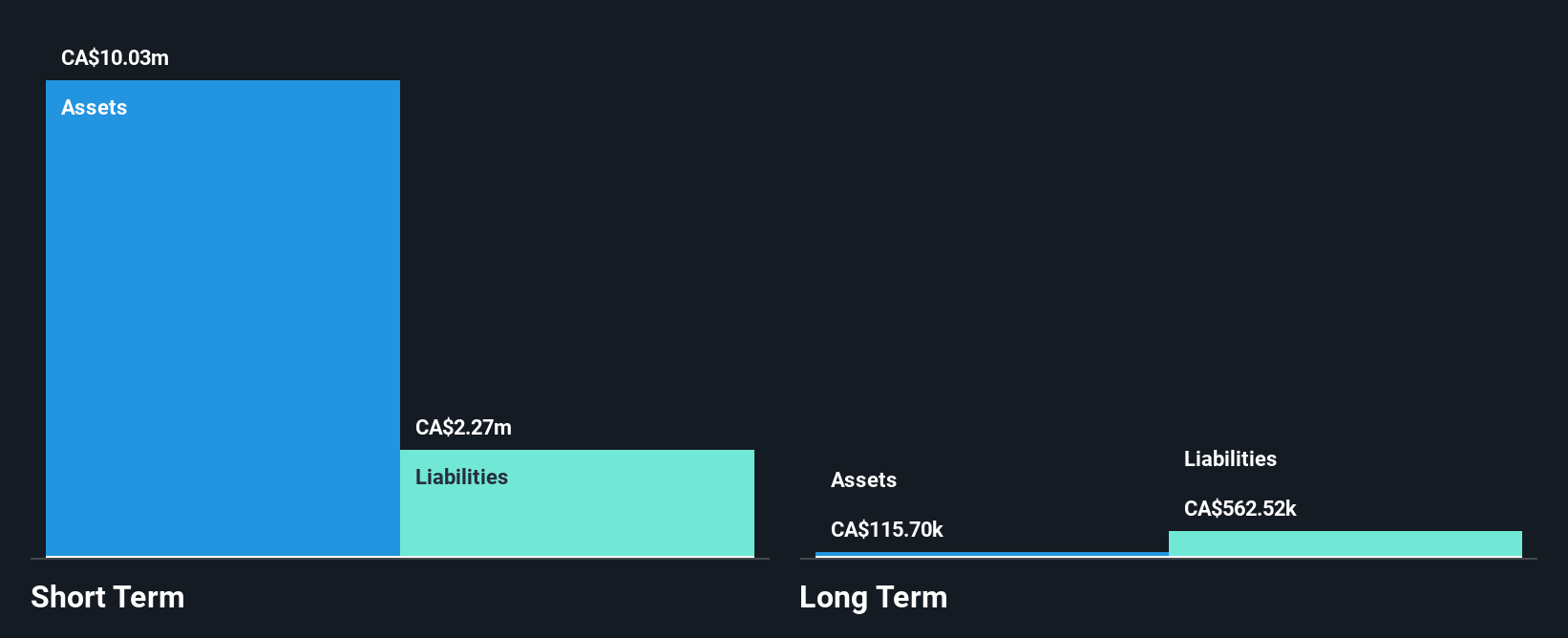

Northern Superior Resources Inc., with a market cap of CA$139.19 million, is a pre-revenue junior mining company focused on gold exploration in Ontario and Québec. The company recently announced a bought deal private placement to raise CA$5.01 million, enhancing its cash runway beyond the current 10 months based on free cash flow estimates. Despite being unprofitable and having experienced increased losses over five years, Northern Superior's ongoing drilling campaign at the Philibert gold property has yielded promising high-grade results, potentially expanding its resource base significantly. The management team is relatively new but considered experienced in the industry context.

- Click to explore a detailed breakdown of our findings in Northern Superior Resources' financial health report.

- Examine Northern Superior Resources' past performance report to understand how it has performed in prior years.

Next Steps

- Investigate our full lineup of 885 TSX Penny Stocks right here.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:INNO

InnoCan Pharma

A pharmaceutical technology company, focuses on the development of various drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients in the United States, Canada, Europe, and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives