- United States

- /

- Food

- /

- NYSE:INGR

Ingredion Incorporated Just Recorded A 8.0% Earnings Beat: Here's What Analysts Think

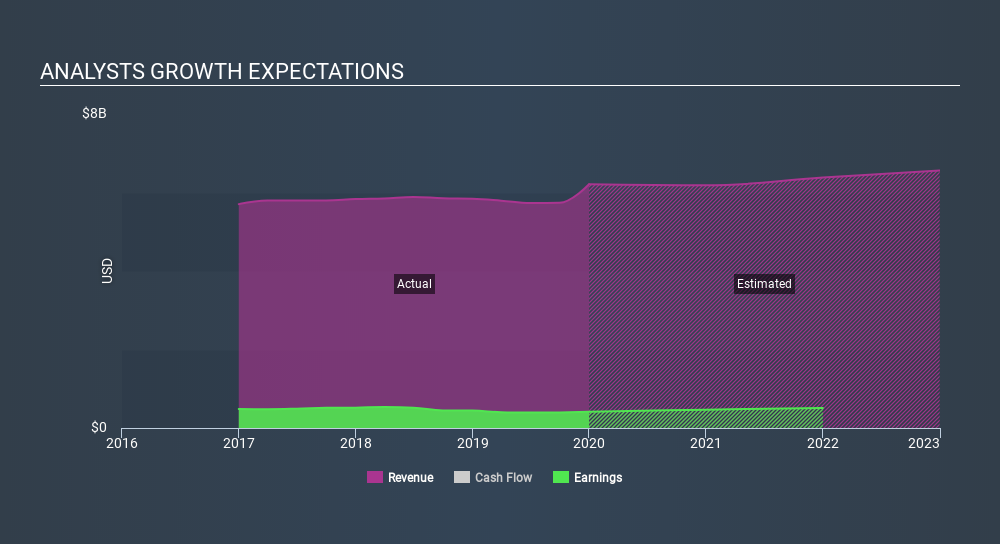

As you might know, Ingredion Incorporated (NYSE:INGR) just kicked off its latest full-year results with some very strong numbers. Results were good overall, with revenues beating analyst predictions by 8.0% to hit US$6.2b. Statutory earnings per share (EPS) came in at US$6.13, some 2.5% above what analysts had expected. This is an important time for investors, as they can track a company's performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Ingredion

Following last week's earnings report, Ingredion's six analysts are forecasting 2020 revenues to be US$6.18b, approximately in line with the last 12 months. Statutory earnings per share are expected to ascend 12% to US$6.92. Before this earnings report, analysts had been forecasting revenues of US$5.85b and earnings per share (EPS) of US$7.08 in 2020. So it's pretty clear consensus is mixed on Ingredion after the latest results; while analysts lifted revenue numbers, they also administered a small dip in per-share earnings expectations.

Analysts also upgraded Ingredion's price target 5.6% to US$103, implying that the higher sales are expected to generate enough value to offset the forecast decline in earnings. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Ingredion, with the most bullish analyst valuing it at US$125 and the most bearish at US$79.00 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

In addition, we can look to Ingredion's past performance and see whether business is expected to improve, and if the company is expected to perform better than wider market. We would highlight that sales are expected to reverse, with the forecast 0.4% revenue decline a notable change from historical growth of 1.1% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same market are forecast to see their revenue grow 2.7% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - analysts also expect Ingredion to grow slower than the wider market.

The Bottom Line

The most important thing to take away is that analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, analysts also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Ingredion going out to 2022, and you can see them free on our platform here..

It might also be worth considering whether Ingredion's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion