Imagine Owning Zenith Exports (NSE:ZENITHEXPO) And Wondering If The 29% Share Price Slide Is Justified

Zenith Exports Limited (NSE:ZENITHEXPO) shareholders should be happy to see the share price up 11% in the last month. But if you look at the last five years the returns have not been good. After all, the share price is down 29% in that time, significantly under-performing the market.

View our latest analysis for Zenith Exports

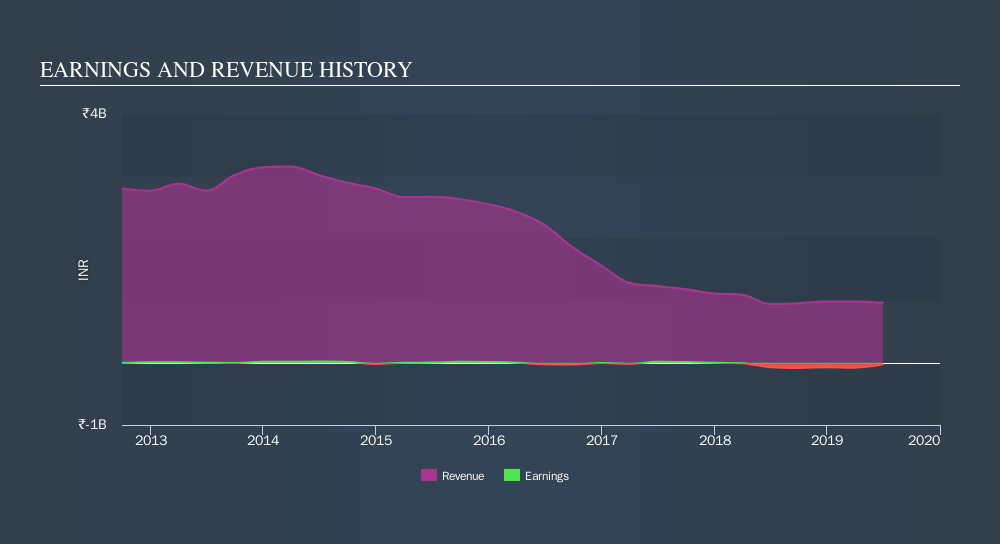

Zenith Exports isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Zenith Exports saw its revenue shrink by 27% per year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 6.7% compound, over five years is well justified by the fundamental deterioration. We doubt many shareholders are delighted with this share price performance. Risk averse investors probably wouldn't like this one much.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While it's never nice to take a loss, Zenith Exports shareholders can take comfort that their trailing twelve month loss of 0.6% wasn't as bad as the market loss of around 4.3%. Of far more concern is the 6.7% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. You could get a better understanding of Zenith Exports's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Zenith Exports may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ZENITHEXPO

Zenith Exports

Engages in the leather goods and textile fabrics businesses for the home and apparel industries in India and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives