Imagine Owning Zenith Exports (NSE:ZENITHEXPO) And Wondering If The 13% Share Price Slide Is Justified

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Zenith Exports Limited (NSE:ZENITHEXPO) shareholders have had that experience, with the share price dropping 13% in three years, versus a market return of about 50%. The silver lining is that the stock is up 2.9% in about a week.

Check out our latest analysis for Zenith Exports

Given that Zenith Exports didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Zenith Exports's revenue dropped 37% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 4.5% compound, over three years is well justified by the fundamental deterioration. It would probably be worth asking whether the company can fund itself to profitability. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

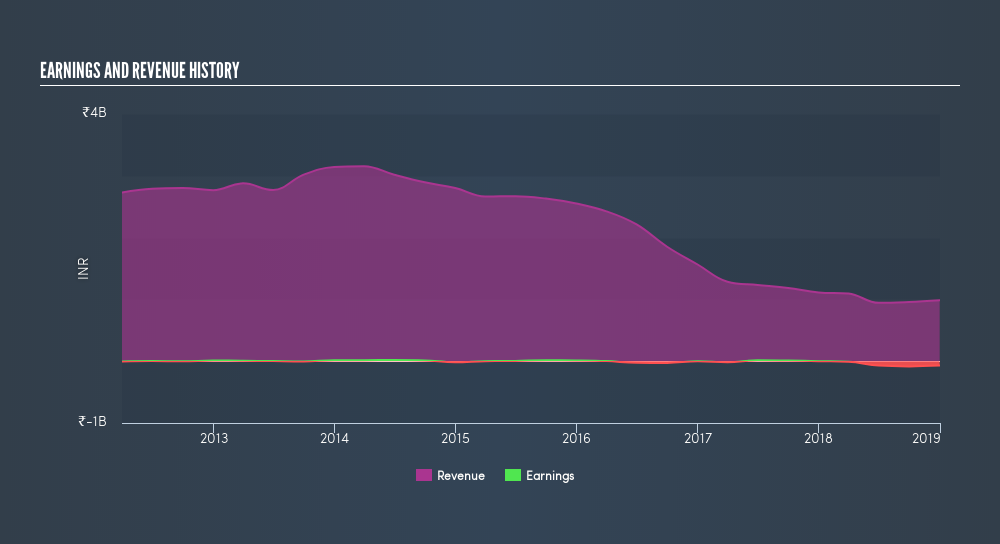

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Zenith Exports's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Zenith Exports shareholders are up 0.6% for the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 1.6% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. You could get a better understanding of Zenith Exports's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ZENITHEXPO

Zenith Exports

Engages in the leather goods and textile fabrics businesses for the home and apparel industries in India and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives