- United States

- /

- Oil and Gas

- /

- NYSE:WLL

Imagine Owning Whiting Petroleum (NYSE:WLL) And Taking A 96% Loss Square On The Chin

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Anyone who held Whiting Petroleum Corporation (NYSE:WLL) for five years would be nursing their metaphorical wounds since the share price dropped 96% in that time. And it's not just long term holders hurting, because the stock is down 84% in the last year. Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Whiting Petroleum

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Whiting Petroleum moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Arguably, the revenue drop of 7.6% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

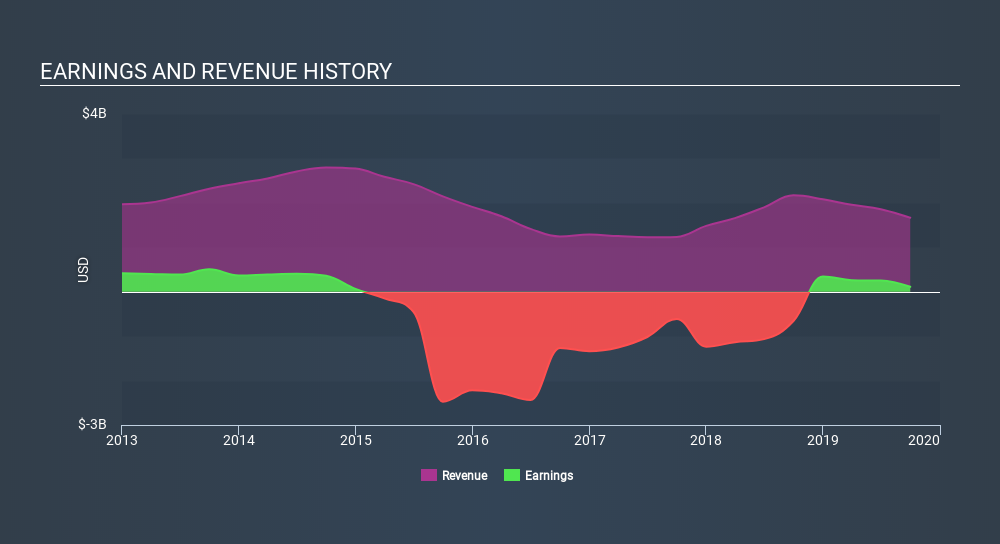

You can see how earnings and revenue have changed over time in the image below.

Whiting Petroleum is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Whiting Petroleum in this interactive graph of future profit estimates.

A Different Perspective

Investors in Whiting Petroleum had a tough year, with a total loss of 84%, against a market gain of about 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 47% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:WLL

Oasis Petroleum

Whiting Petroleum Corporation operates as an independent exploration and production company in the Williston Basin, the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives