- India

- /

- Trade Distributors

- /

- NSEI:SIGIND

Imagine Owning Signet Industries (NSE:SIGIND) And Trying To Stomach The 91% Share Price Drop

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Signet Industries Limited (NSE:SIGIND); the share price is down a whopping 91% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 41%, so we doubt many shareholders are delighted. On the other hand the share price has bounced 6.1% over the last week.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Signet Industries

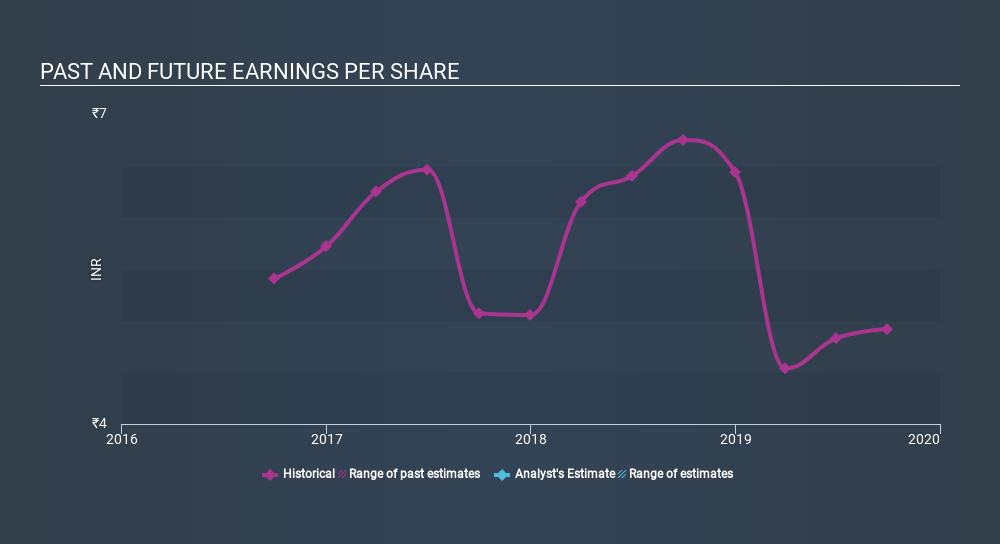

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Signet Industries saw its EPS decline at a compound rate of 3.1% per year, over the last three years. This reduction in EPS is slower than the 56% annual reduction in the share price. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 4.46.

The graphic below depicts how EPS has changed over time.

This free interactive report on Signet Industries's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 7.7% in the last year, Signet Industries shareholders lost 40% (even including dividends) . Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 28% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Signet Industries it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:SIGIND

Signet Industries

Primarily engages in the merchant trading of various polymer and plastic granules in India.

Solid track record with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion