- United States

- /

- Biotech

- /

- NasdaqGS:LXRX

Imagine Owning Lexicon Pharmaceuticals (NASDAQ:LXRX) And Trying To Stomach The 70% Share Price Drop

Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX) shareholders will doubtless be very grateful to see the share price up 65% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 70% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

Check out our latest analysis for Lexicon Pharmaceuticals

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Lexicon Pharmaceuticals moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 9.7% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Lexicon Pharmaceuticals more closely, as sometimes stocks fall unfairly. This could present an opportunity.

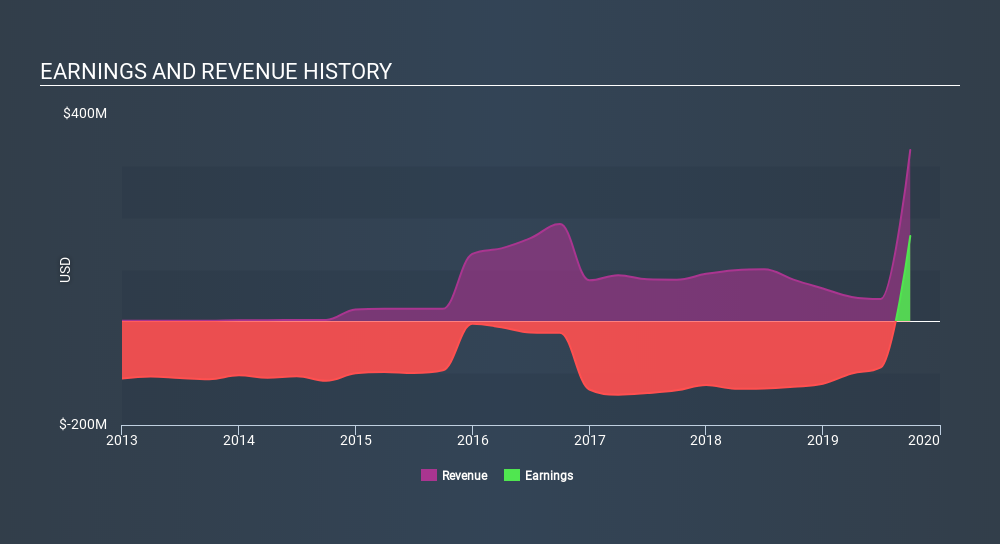

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Lexicon Pharmaceuticals stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 28% in the last year, Lexicon Pharmaceuticals shareholders lost 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:LXRX

Lexicon Pharmaceuticals

A biopharmaceutical company, focuses on the discovery, development, and commercialization of pharmaceutical products for the treatment of human disease.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives