- United States

- /

- Auto Components

- /

- NasdaqGS:KNDI

Imagine Owning Kandi Technologies Group (NASDAQ:KNDI) And Trying To Stomach The 74% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Kandi Technologies Group, Inc. (NASDAQ:KNDI) shareholders should be happy to see the share price up 19% in the last month. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Like a ship taking on water, the share price has sunk 74% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Check out our latest analysis for Kandi Technologies Group

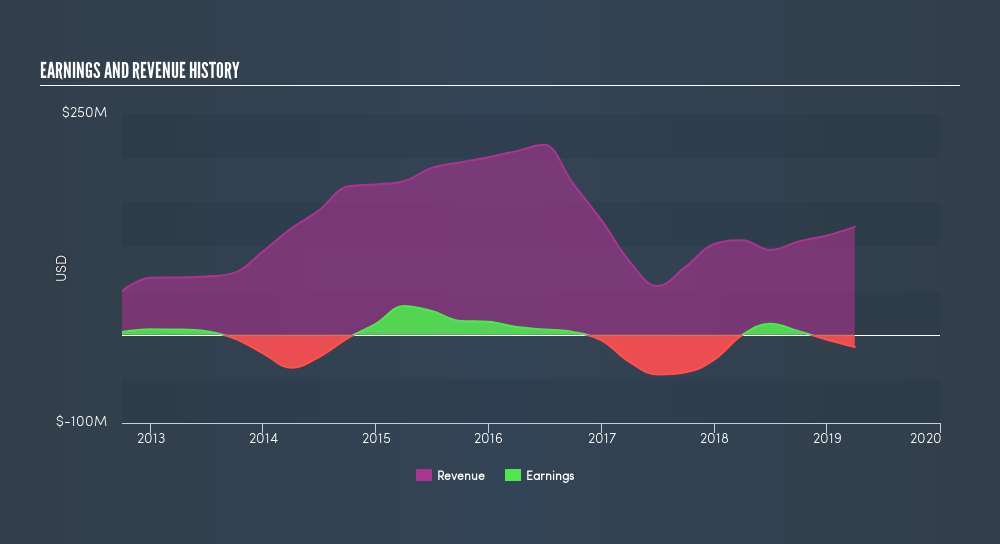

Kandi Technologies Group isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Kandi Technologies Group reduced its trailing twelve month revenue by 12% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 24% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Kandi Technologies Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Kandi Technologies Group shareholders have received a total shareholder return of 22% over one year. There's no doubt those recent returns are much better than the TSR loss of 24% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:KNDI

Kandi Technologies Group

Engages in designing, developing, manufacturing, and commercializing electric vehicle (EV) products and parts in the People’s Republic of China, the United States and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives