- Hong Kong

- /

- Basic Materials

- /

- SEHK:2233

If You Like EPS Growth Then Check Out West China Cement (HKG:2233) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like West China Cement (HKG:2233). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for West China Cement

West China Cement's Improving Profits

Over the last three years, West China Cement has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, West China Cement's EPS soared from CN¥0.21 to CN¥0.33, in just one year. That's a impressive gain of 55%.

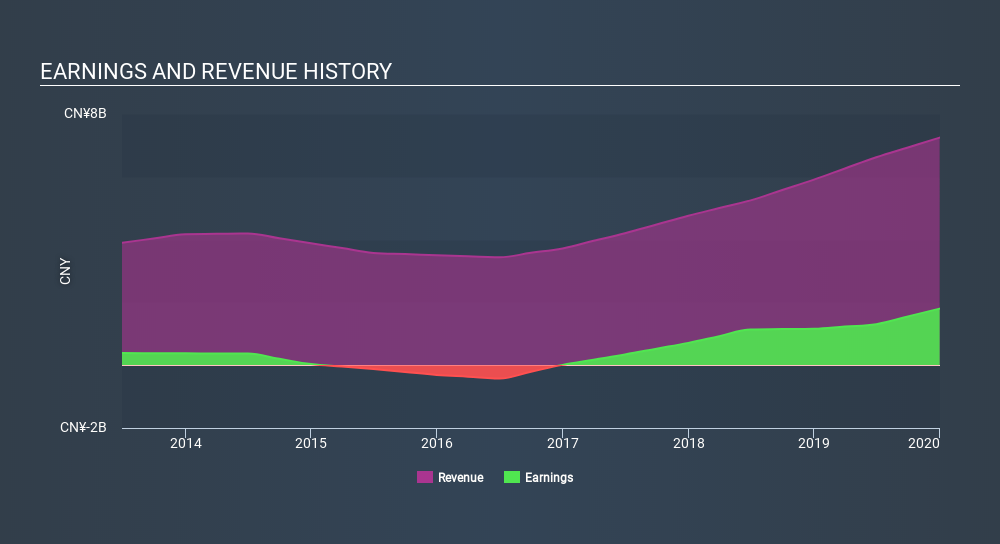

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note West China Cement's EBIT margins were flat over the last year, revenue grew by a solid 23% to CN¥7.2b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future West China Cement EPS 100% free.

Are West China Cement Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that West China Cement insiders own a significant number of shares certainly appeals to me. Actually, with 36% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. And their holding is extremely valuable at the current share price, totalling CN¥3.2b. Now that's what I call some serious skin in the game!

Should You Add West China Cement To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about West China Cement's strong EPS growth. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with West China Cement (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:2233

West China Cement

An investment holding company, manufactures and sells cement and cement products in the People’s Republic of China, Mozambique, Ethiopia, Democratic Republic of Congo, Other African countries, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives