- Singapore

- /

- Food and Staples Retail

- /

- SGX:OV8

If You Like EPS Growth Then Check Out Sheng Siong Group (SGX:OV8) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Sheng Siong Group (SGX:OV8). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Sheng Siong Group

How Fast Is Sheng Siong Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Sheng Siong Group has grown EPS by 7.0% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

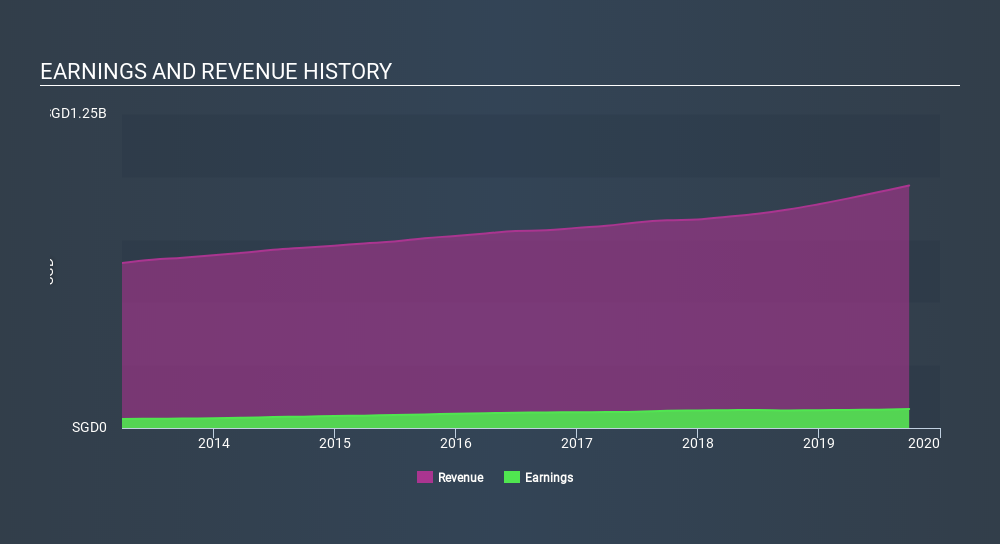

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Sheng Siong Group maintained stable EBIT margins over the last year, all while growing revenue 11% to S$965m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Sheng Siong Group's forecast profits?

Are Sheng Siong Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first; I didn't see insiders sell Sheng Siong Group shares in the last year. But the really good news is that CEO & Executive Director Hock Chee Lim spent S$563k buying stock stock, at an average price of around S$1.13. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Sheng Siong Group insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at S$563m. Coming in at 29% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Is Sheng Siong Group Worth Keeping An Eye On?

As I already mentioned, Sheng Siong Group is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. If you think Sheng Siong Group might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

The good news is that Sheng Siong Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:OV8

Sheng Siong Group

An investment holding company, operates a chain of supermarket retail stores in Singapore.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives