- South Korea

- /

- Luxury

- /

- KOSDAQ:A159580

If You Had Bought Zero to Seven (KOSDAQ:159580) Shares A Year Ago You'd Have Made 57%

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Zero to Seven Inc. (KOSDAQ:159580) share price is 57% higher than it was a year ago, much better than the market return of around 0.7% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! However, the stock hasn't done so well in the longer term, with the stock only up 24% in three years.

See our latest analysis for Zero to Seven

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Zero to Seven went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 44% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

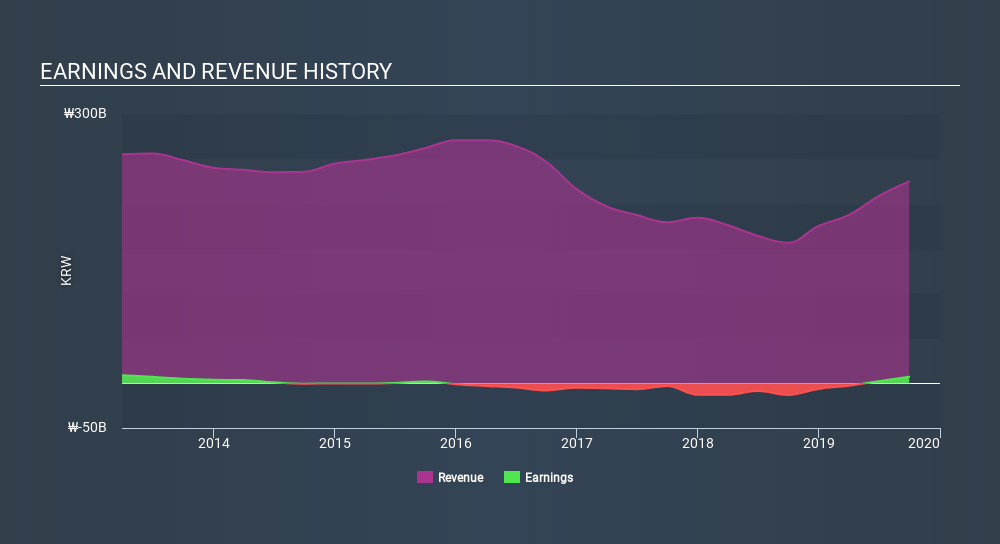

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Zero to Seven has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Zero to Seven has rewarded shareholders with a total shareholder return of 57% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4.5% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Zero to Seven (including 1 which is is a bit unpleasant) .

Of course Zero to Seven may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KOSDAQ:A159580

Zero to Seven

Operates as a childcare company in South Korea and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives