- Canada

- /

- Metals and Mining

- /

- TSXV:TSD

If You Had Bought Tsodilo Resources (CVE:TSD) Stock Five Years Ago, You'd Be Sitting On A 89% Loss, Today

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Imagine if you held Tsodilo Resources Limited (CVE:TSD) for half a decade as the share price tanked 89%. And we doubt long term believers are the only worried holders, since the stock price has declined 73% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Tsodilo Resources

Tsodilo Resources didn't have any revenue in the last year, so it's fair to say it doesn't yet have a proven product (or at least not one people are paying for). You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that Tsodilo Resources finds some valuable resources, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Tsodilo Resources investors have already had a taste of the bitterness stocks like this can leave in the mouth.

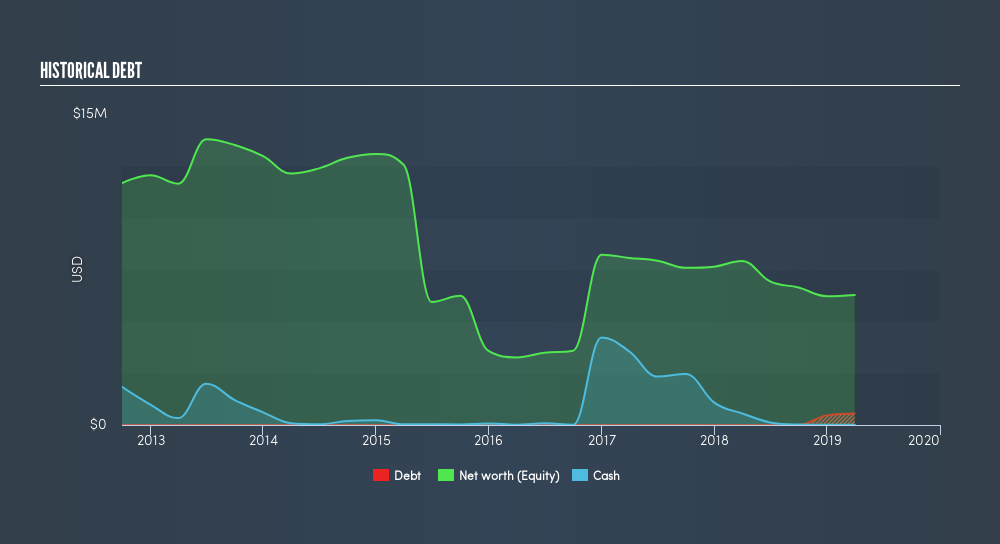

Tsodilo Resources had liabilities exceeding cash by US$1,089,625 when it last reported in March 2019, according to our data. That puts it in the highest risk category, according to our analysis. But since the share price has dived -36% per year, over 5 years, it looks like some investors think it's time to abandon ship, so to speak. The image below shows how Tsodilo Resources's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

While the broader market gained around 1.7% in the last year, Tsodilo Resources shareholders lost 73%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 36% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:TSD

Tsodilo Resources

An exploration stage company, engages in the acquisition, exploration, and development of mineral properties in the Republic of Botswana.

Slight and overvalued.

Market Insights

Community Narratives