- Brazil

- /

- Trade Distributors

- /

- BOVESPA:MILS3

If You Had Bought Mills Estruturas e Serviços de Engenharia (BVMF:MILS3) Stock Three Years Ago, You Could Pocket A 101% Gain Today

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Mills Estruturas e Serviços de Engenharia S.A. (BVMF:MILS3) share price has flown 101% in the last three years. That sort of return is as solid as granite. And in the last month, the share price has gained 8.0%.

Check out our latest analysis for Mills Estruturas e Serviços de Engenharia

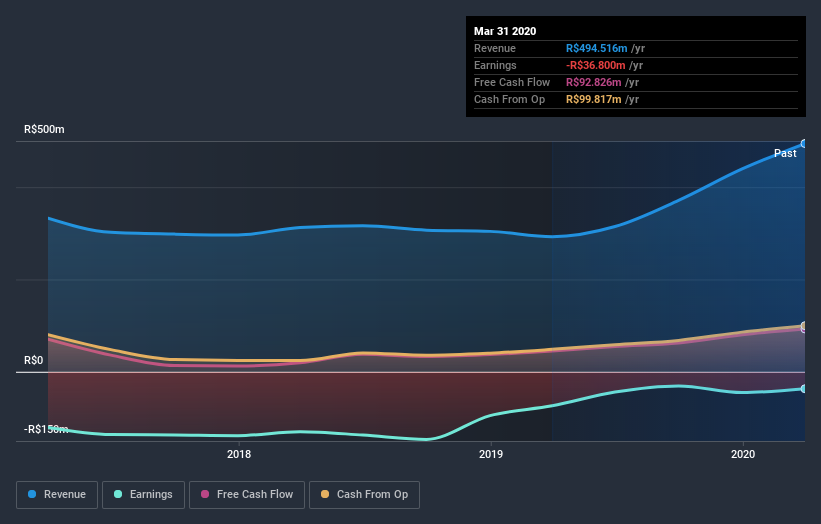

Mills Estruturas e Serviços de Engenharia isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Mills Estruturas e Serviços de Engenharia saw its revenue grow at 13% per year. That's a very respectable growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 26% per year over three years. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Mills Estruturas e Serviços de Engenharia has rewarded shareholders with a total shareholder return of 18% in the last twelve months. That gain is better than the annual TSR over five years, which is 4.6%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Mills Estruturas e Serviços de Engenharia better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Mills Estruturas e Serviços de Engenharia (including 1 which is doesn't sit too well with us) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

When trading Mills Estruturas e Serviços de Engenharia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:MILS3

Mills Locação Serviços e Logística

Operates as a machinery and equipment rental company in Brazil.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success