- Italy

- /

- Auto Components

- /

- BIT:BRE

If You Had Bought Brembo (BIT:BRE) Shares Five Years Ago You'd Have Made 100%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Brembo share price has climbed 100% in five years, easily topping the market return of -30% (ignoring dividends).

Check out our latest analysis for Brembo

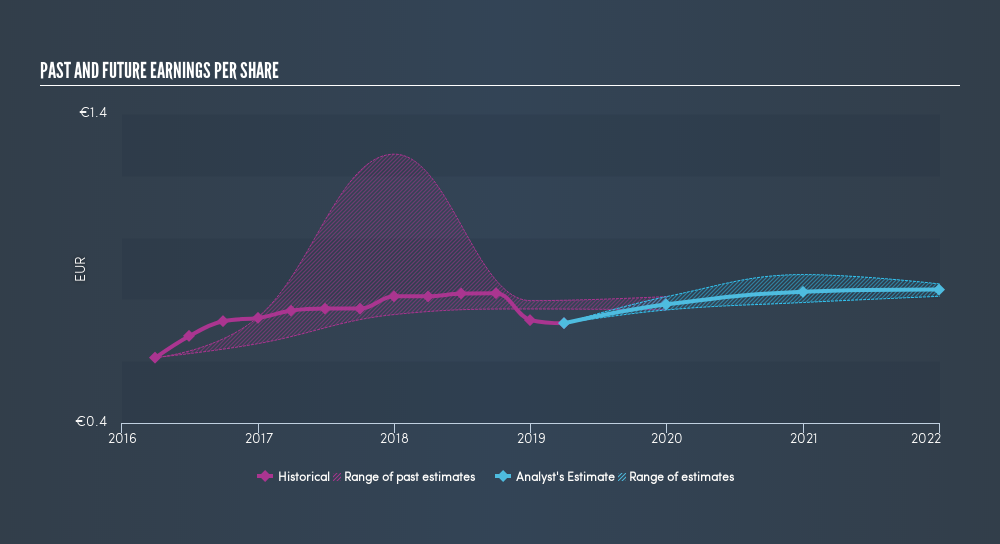

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Brembo achieved compound earnings per share (EPS) growth of 18% per year. So the EPS growth rate is rather close to the annualized share price gain of 15% per year. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Brembo's TSR for the last 5 years was 119%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Brembo had a tough year, with a total loss of 5.4% (including dividends), against a market gain of about 3.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 17% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before deciding if you like the current share price, check how Brembo scores on these 3 valuation metrics.

But note: Brembo may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:BRE

Brembo

Designs, develops, and distributes braking systems and components for cars, motorbikes, and commercial vehicles.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives