- United States

- /

- Machinery

- /

- NasdaqCM:ARTW

If You Had Bought Art's-Way Manufacturing (NASDAQ:ARTW) Stock Five Years Ago, You'd Be Sitting On A 53% Loss, Today

While it may not be enough for some shareholders, we think it is good to see the Art's-Way Manufacturing Co., Inc. (NASDAQ:ARTW) share price up 22% in a single quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. In that time the share price has delivered a rude shock to holders, who find themselves down 53% after a long stretch. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

Check out our latest analysis for Art's-Way Manufacturing

Art's-Way Manufacturing wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

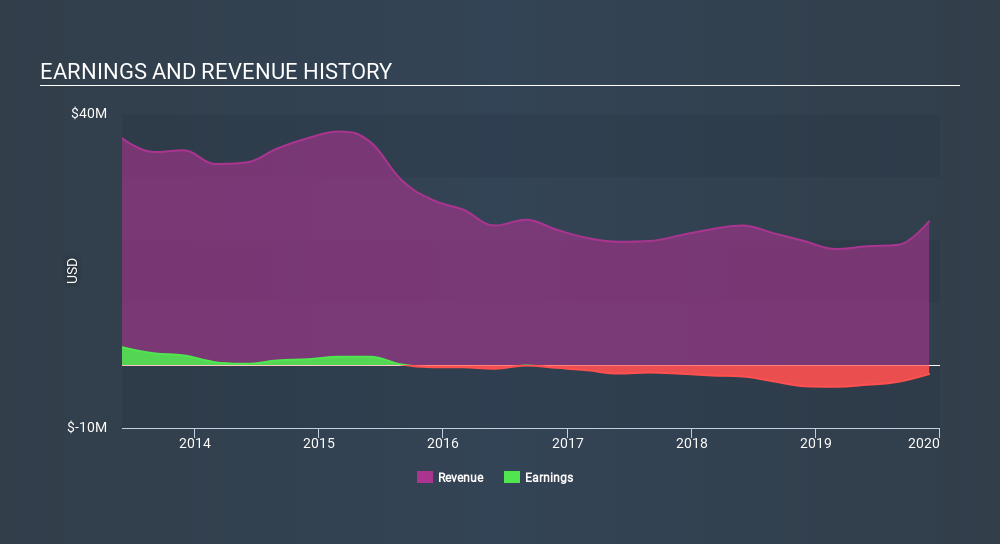

In the last five years Art's-Way Manufacturing saw its revenue shrink by 12% per year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 14% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While it's certainly disappointing to see that Art's-Way Manufacturing shares lost 1.4% throughout the year, that wasn't as bad as the market loss of 13%. Of far more concern is the 14% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Art's-Way Manufacturing (2 make us uncomfortable) that you should be aware of.

But note: Art's-Way Manufacturing may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:ARTW

Art's-Way Manufacturing

Manufactures and sells agricultural equipment, and specialized modular science and agricultural buildings worldwide.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives