- Hong Kong

- /

- Real Estate

- /

- SEHK:95

I Ran A Stock Scan For Earnings Growth And LVGEM (China) Real Estate Investment (HKG:95) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like LVGEM (China) Real Estate Investment (HKG:95). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for LVGEM (China) Real Estate Investment

How Fast Is LVGEM (China) Real Estate Investment Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, LVGEM (China) Real Estate Investment's EPS has grown 25% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

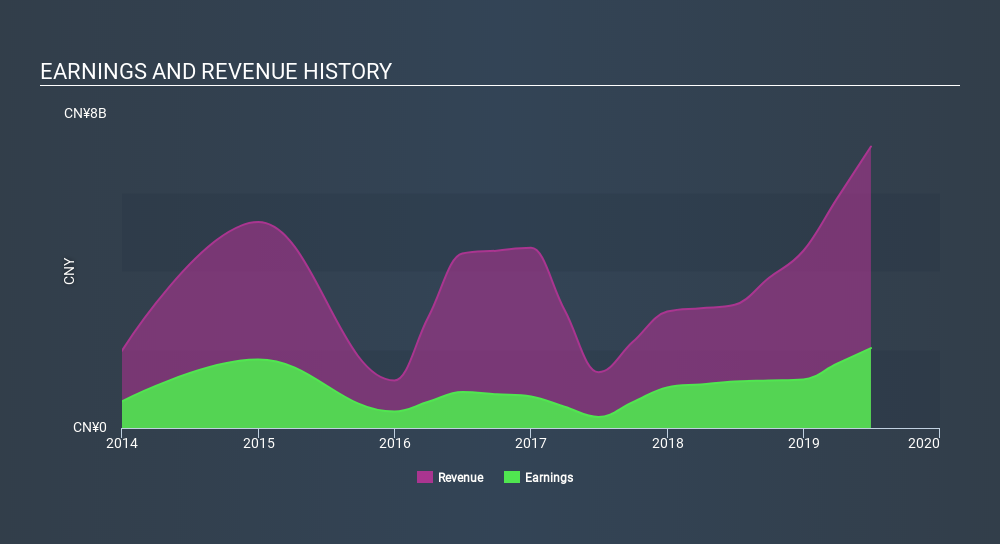

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). LVGEM (China) Real Estate Investment shareholders can take confidence from the fact that EBIT margins are up from 50% to 58%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are LVGEM (China) Real Estate Investment Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that LVGEM (China) Real Estate Investment insiders own a significant number of shares certainly appeals to me. In fact, they own 68% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping CN¥8.2b. That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like LVGEM (China) Real Estate Investment with market caps between CN¥6.9b and CN¥22b is about CN¥3.9m.

The LVGEM (China) Real Estate Investment CEO received CN¥3.2m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is LVGEM (China) Real Estate Investment Worth Keeping An Eye On?

For growth investors like me, LVGEM (China) Real Estate Investment's raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the takeaway for me is that LVGEM (China) Real Estate Investment is worth keeping an eye on. It is worth noting though that we have found 3 warning signs for LVGEM (China) Real Estate Investment (1 is significant!) that you need to take into consideration.

Although LVGEM (China) Real Estate Investment certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:95

LVGEM (China) Real Estate Investment

An investment holding company, engages in property development and investment businesses in the People’s Republic of China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives