- United States

- /

- Banks

- /

- NasdaqGS:FBIZ

I Ran A Stock Scan For Earnings Growth And First Business Financial Services (NASDAQ:FBIZ) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like First Business Financial Services (NASDAQ:FBIZ). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for First Business Financial Services

First Business Financial Services's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, First Business Financial Services has grown EPS by 13% per year. That's a pretty good rate, if the company can sustain it.

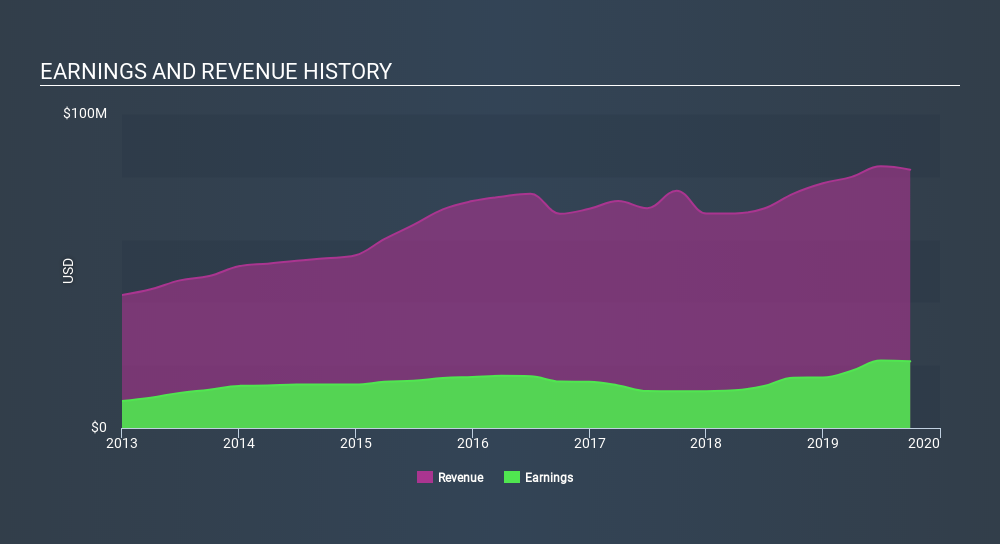

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that First Business Financial Services's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note First Business Financial Services's EBIT margins were flat over the last year, revenue grew by a solid 10% to US$82m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of First Business Financial Services's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are First Business Financial Services Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that First Business Financial Services insiders have a significant amount of capital invested in the stock. Indeed, they hold US$17m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 7.3% of the company, demonstrating a degree of high-level alignment with shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between US$100m and US$400m, like First Business Financial Services, the median CEO pay is around US$1.1m.

The First Business Financial Services CEO received US$900k in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does First Business Financial Services Deserve A Spot On Your Watchlist?

One positive for First Business Financial Services is that it is growing EPS. That's nice to see. Earnings growth might be the main game for First Business Financial Services, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of First Business Financial Services. You might benefit from giving it a glance today.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:FBIZ

First Business Financial Services

Operates as the bank holding company for First Business Bank that provides commercial banking products and services for small and medium-sized businesses, business owners, executives, professionals, and high net worth individuals in Wisconsin, Kansas, and Missouri.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives