- United States

- /

- Commercial Services

- /

- NasdaqGS:LQDT

How Should Investors React To Liquidity Services, Inc.'s (NASDAQ:LQDT) CEO Pay?

Bill Angrick became the CEO of Liquidity Services, Inc. (NASDAQ:LQDT) in 2000. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Liquidity Services

How Does Bill Angrick's Compensation Compare With Similar Sized Companies?

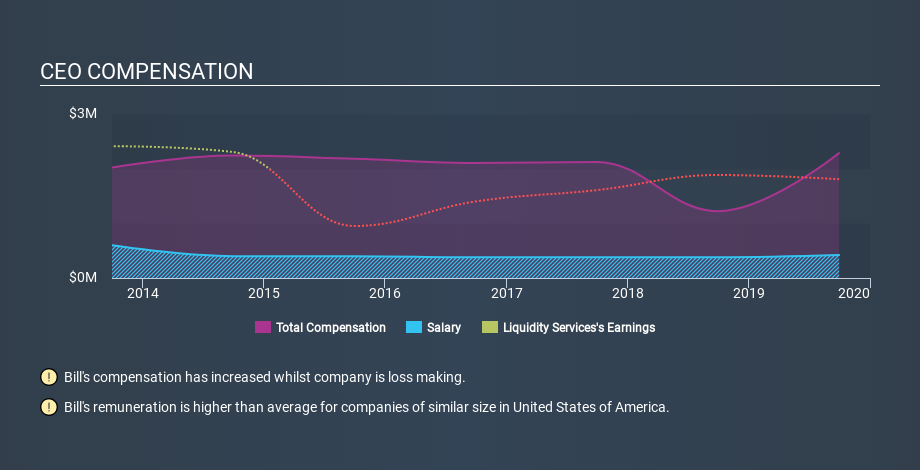

Our data indicates that Liquidity Services, Inc. is worth US$141m, and total annual CEO compensation was reported as US$2.3m for the year to September 2019. That's a notable increase of 87% on last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$420k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO total compensation in that group is US$616k.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Liquidity Services stands. Speaking on an industry level, we can see that nearly 29% of total compensation represents salary, while the remainder of 71% is other remuneration. Liquidity Services sets aside a smaller share of compensation for salary, in comparison to the overall industry.

As you can see, Bill Angrick is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Liquidity Services, Inc. is paying too much. We can get a better idea of how generous the pay is by looking at the performance of the underlying business. You can see, below, how CEO compensation at Liquidity Services has changed over time.

Is Liquidity Services, Inc. Growing?

On average over the last three years, Liquidity Services, Inc. has grown earnings per share (EPS) by 62% each year (using a line of best fit). Its revenue is up 2.1% over last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. You might want to check this free visual report on analyst forecasts for future earnings.

Has Liquidity Services, Inc. Been A Good Investment?

With a three year total loss of 46%, Liquidity Services, Inc. would certainly have some dissatisfied shareholders. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared the total CEO remuneration paid by Liquidity Services, Inc., and compared it to remuneration at a group of similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

However, the earnings per share growth over three years is certainly impressive. Having said that, shareholders may be disappointed with the weak returns over the last three years. This contrasts with the growth in CEO remuneration, in the last year. One might thus conclude that it would be better if the company waited until growth is reflected in the share price, before increasing CEO compensation. Moving away from CEO compensation for the moment, we've identified 3 warning signs for Liquidity Services that you should be aware of before investing.

Important note: Liquidity Services may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:LQDT

Liquidity Services

Engages in the provision of e-commerce marketplaces, self-directed auction listing tools, and value-added services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion