This article will reflect on the compensation paid to Boris Ivesha who has served as CEO of PPHE Hotel Group Limited (LON:PPH) since 2007. This analysis will also assess whether PPHE Hotel Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for PPHE Hotel Group

Comparing PPHE Hotel Group Limited's CEO Compensation With the industry

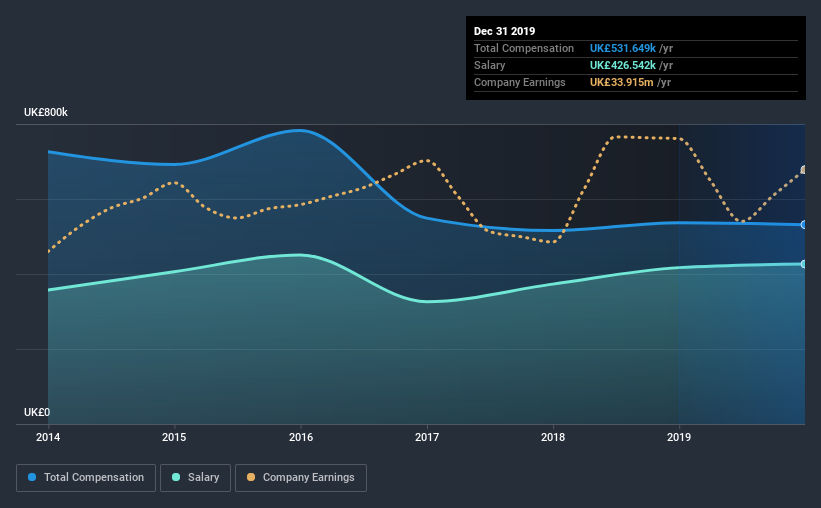

According to our data, PPHE Hotel Group Limited has a market capitalization of UK£452m, and paid its CEO total annual compensation worth UK£532k over the year to December 2019. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at UK£426.5k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from UK£159m to UK£634m, we found that the median CEO total compensation was UK£651k. This suggests that PPHE Hotel Group remunerates its CEO largely in line with the industry average. Moreover, Boris Ivesha also holds UK£49m worth of PPHE Hotel Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£427k | UK£417k | 80% |

| Other | UK£105k | UK£120k | 20% |

| Total Compensation | UK£532k | UK£537k | 100% |

On an industry level, roughly 60% of total compensation represents salary and 40% is other remuneration. It's interesting to note that PPHE Hotel Group pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

PPHE Hotel Group Limited's Growth

Over the last three years, PPHE Hotel Group Limited has shrunk its earnings per share by 1.3% per year. It achieved revenue growth of 4.7% over the last year.

Its a bit disappointing to see that the company has failed to grow its earnings. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has PPHE Hotel Group Limited Been A Good Investment?

Most shareholders would probably be pleased with PPHE Hotel Group Limited for providing a total return of 34% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As previously discussed, Boris is compensated close to the median for companies of its size, and which belong to the same industry. Some investors may take issue with this, especially considering shrinking earnings for the past three years. But on the bright side, shareholder returns have moved northward during the same period. We're not saying CEO compensation is too generous, but shrinking EPS is undoubtedly an issue that will have to be addressed.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for PPHE Hotel Group (1 shouldn't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading PPHE Hotel Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:PPH

PPHE Hotel Group

Owns, co-owns, develops, leases, operates, and franchises hospitality real estate in the Netherlands, the United Kingdom, Germany, Croatia, Austria, Hungary, Italy, and Serbia.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion