- Hong Kong

- /

- Real Estate

- /

- SEHK:683

How Kerry Properties Limited (HKG:683) Could Add Value To Your Portfolio

I've been keeping an eye on Kerry Properties Limited (HKG:683) because I'm attracted to its fundamentals. Looking at the company as a whole, as a potential stock investment, I believe 683 has a lot to offer. Basically, it is a well-regarded dividend-paying company that has been able to sustain great financial health over the past. Below is a brief commentary on these key aspects. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Kerry Properties here.

Excellent balance sheet established dividend payer

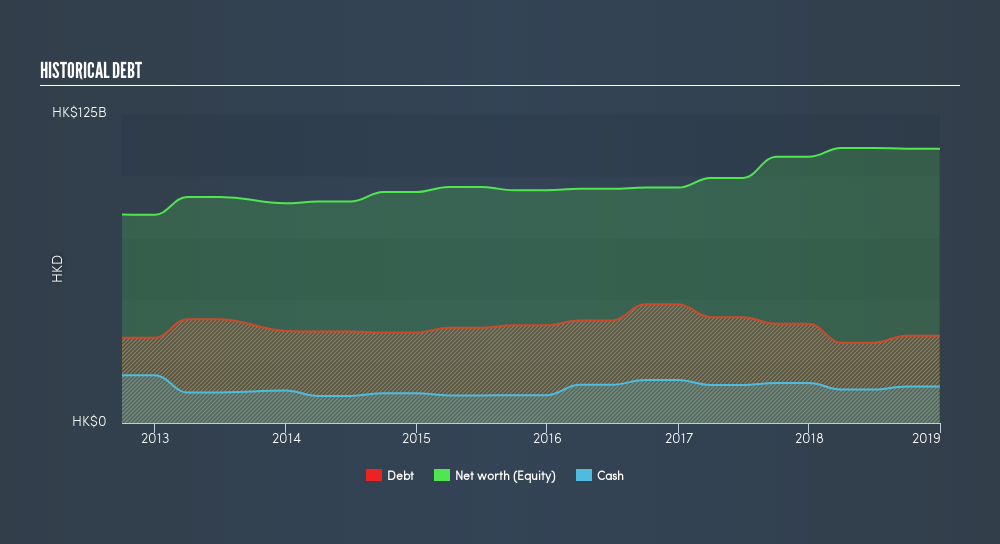

683's strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This implies that 683 manages its cash and cost levels well, which is a key determinant of the company’s health. 683 appears to have made good use of debt, producing operating cash levels of 0.45x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated.

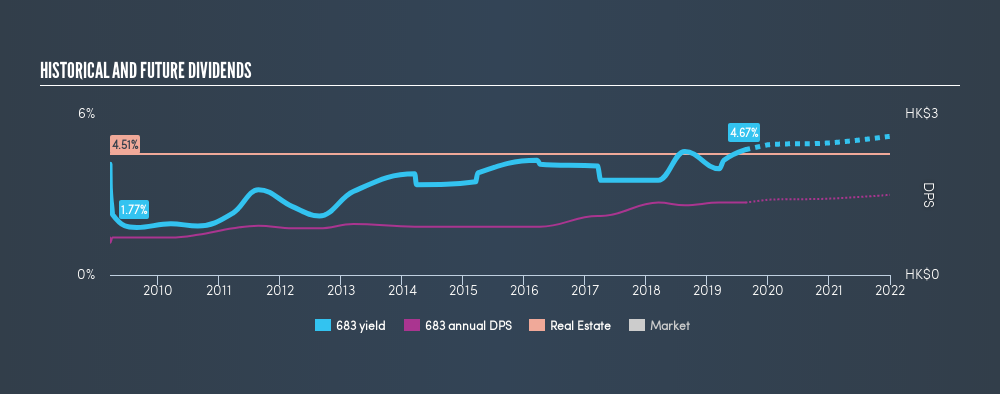

For those seeking income streams from their portfolio, 683 is a robust dividend payer as well. Over the past decade, the company has consistently increased its dividend payout, reaching a yield of 4.7%.

Next Steps:

For Kerry Properties, there are three important aspects you should further examine:

- Future Outlook: What are well-informed industry analysts predicting for 683’s future growth? Take a look at our free research report of analyst consensus for 683’s outlook.

- Historical Performance: What has 683's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of 683? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:683

Kerry Properties

An investment holding company, engages in the development, investment, management, and trading of properties in Hong Kong, Mainland China, and the Asia Pacific region.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion