- United Kingdom

- /

- Trade Distributors

- /

- AIM:ASY

How Is Andrews Sykes Group's (LON:ASY) CEO Compensated?

Paul Wood has been the CEO of Andrews Sykes Group plc (LON:ASY) since 2006, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Andrews Sykes Group.

Check out our latest analysis for Andrews Sykes Group

How Does Total Compensation For Paul Wood Compare With Other Companies In The Industry?

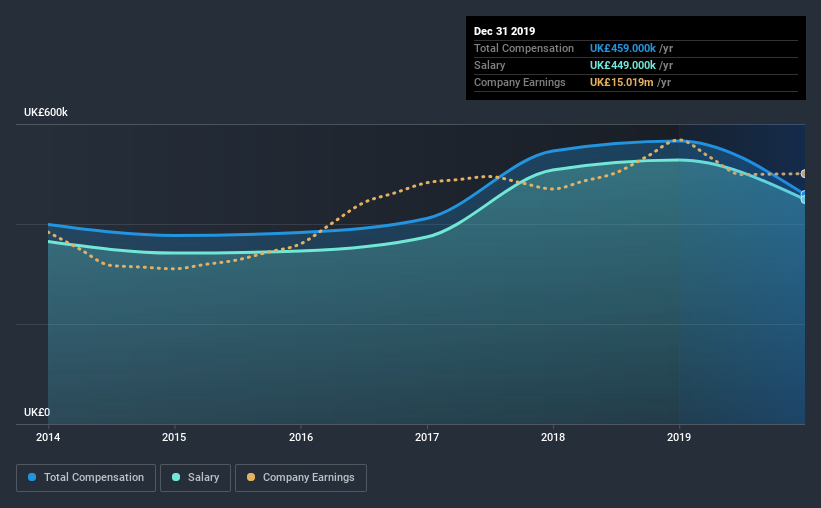

According to our data, Andrews Sykes Group plc has a market capitalization of UK£266m, and paid its CEO total annual compensation worth UK£459k over the year to December 2019. We note that's a decrease of 19% compared to last year. We note that the salary portion, which stands at UK£449.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from UK£152m to UK£609m, we found that the median CEO total compensation was UK£575k. From this we gather that Paul Wood is paid around the median for CEOs in the industry. Moreover, Paul Wood also holds UK£50k worth of Andrews Sykes Group stock directly under their own name.

On an industry level, around 55% of total compensation represents salary and 45% is other remuneration. Andrews Sykes Group is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Andrews Sykes Group plc's Growth

Over the past three years, Andrews Sykes Group plc has seen its earnings per share (EPS) grow by 1.3% per year. It saw its revenue drop 1.7% over the last year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest EPS growth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Andrews Sykes Group plc Been A Good Investment?

Andrews Sykes Group plc has served shareholders reasonably well, with a total return of 25% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Andrews Sykes Group pays its CEO a majority of compensation through a salary. As we touched on above, Andrews Sykes Group plc is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But the company has failed to produce substantial growth in either earnings or total shareholder return. So, although the CEO compensation seems reasonable, shareholders might want to see some further progress before they agree that Paul should get a raise.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Andrews Sykes Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Andrews Sykes Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:ASY

Andrews Sykes Group

An investment holding company, engages in the hire, sale, and installation of environmental control equipment in the United Kingdom, Rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.