- Norway

- /

- Marine and Shipping

- /

- OB:WILS

How Does Wilson's (OB:WILS) P/E Compare To Its Industry, After Its Big Share Price Gain?

Wilson (OB:WILS) shares have had a really impressive month, gaining 31%, after some slippage. The full year gain of 24% is pretty reasonable, too.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

Check out our latest analysis for Wilson

How Does Wilson's P/E Ratio Compare To Its Peers?

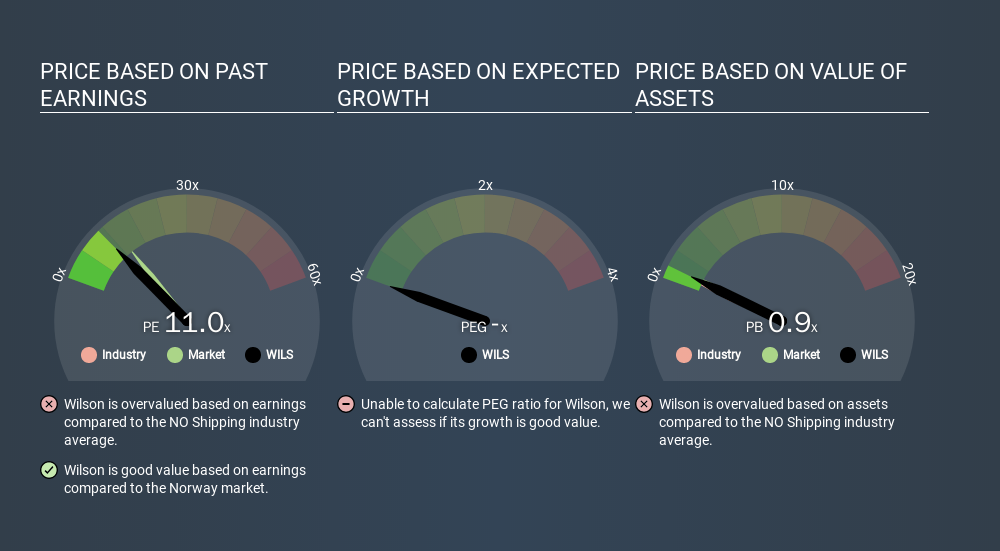

Wilson's P/E is 10.97. The image below shows that Wilson has a P/E ratio that is roughly in line with the shipping industry average (11.0).

That indicates that the market expects Wilson will perform roughly in line with other companies in its industry. The company could surprise by performing better than average, in the future. Checking factors such as director buying and selling. could help you form your own view on if that will happen.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Wilson shrunk earnings per share by 10% over the last year. And it has shrunk its earnings per share by 3.0% per year over the last five years. This growth rate might warrant a below average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Wilson's Balance Sheet

Net debt totals a substantial 101% of Wilson's market cap. If you want to compare its P/E ratio to other companies, you must keep in mind that these debt levels would usually warrant a relatively low P/E.

The Verdict On Wilson's P/E Ratio

Wilson's P/E is 11.0 which is below average (13.8) in the NO market. Given meaningful debt, and a lack of recent growth, the market looks to be extrapolating this recent performance; reflecting low expectations for the future. What we know for sure is that investors have become more excited about Wilson recently, since they have pushed its P/E ratio from 8.4 to 11.0 over the last month. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors should be looking to buy stocks that the market is wrong about. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

But note: Wilson may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OB:WILS

Solid track record and good value.

Market Insights

Community Narratives