How Does Tasty Bite Eatables's (NSE:TASTYBITE) P/E Compare To Its Industry, After Its Big Share Price Gain?

It's great to see Tasty Bite Eatables (NSE:TASTYBITE) shareholders have their patience rewarded with a 35% share price pop in the last month. And the full year gain of 33% isn't too shabby, either!

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

Check out our latest analysis for Tasty Bite Eatables

Does Tasty Bite Eatables Have A Relatively High Or Low P/E For Its Industry?

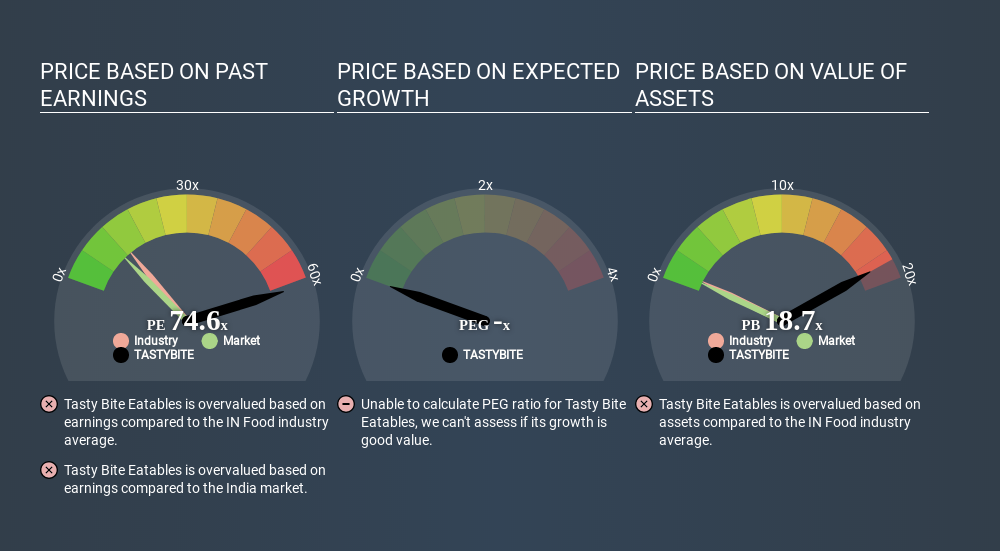

Tasty Bite Eatables's P/E of 75.79 indicates some degree of optimism towards the stock. The image below shows that Tasty Bite Eatables has a significantly higher P/E than the average (13.6) P/E for companies in the food industry.

Tasty Bite Eatables's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Shareholders are clearly optimistic, but the future is always uncertain. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. Earnings growth means that in the future the 'E' will be higher. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Notably, Tasty Bite Eatables grew EPS by a whopping 36% in the last year. And it has bolstered its earnings per share by 31% per year over the last five years. I'd therefore be a little surprised if its P/E ratio was not relatively high.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting Tasty Bite Eatables's P/E?

Tasty Bite Eatables's net debt is 1.5% of its market cap. So it doesn't have as many options as it would with net cash, but its debt would not have much of an impact on its P/E ratio.

The Verdict On Tasty Bite Eatables's P/E Ratio

Tasty Bite Eatables's P/E is 75.8 which suggests the market is more focussed on the future opportunity rather than the current level of earnings. While the company does use modest debt, its recent earnings growth is superb. So on this analysis a high P/E ratio seems reasonable. What we know for sure is that investors have become much more excited about Tasty Bite Eatables recently, since they have pushed its P/E ratio from 56.2 to 75.8 over the last month. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Of course you might be able to find a better stock than Tasty Bite Eatables. So you may wish to see this free collection of other companies that have grown earnings strongly.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:TASTYBITE

Tasty Bite Eatables

Manufactures and sells prepared foods in India and internationally.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives