- Hong Kong

- /

- Entertainment

- /

- SEHK:136

How Does HengTen Networks Group's (HKG:136) P/E Compare To Its Industry, After The Share Price Drop?

Unfortunately for some shareholders, the HengTen Networks Group (HKG:136) share price has dived 34% in the last thirty days. And that drop will have no doubt have some shareholders concerned that the 73% share price decline, over the last year, has turned them into bagholders. For those wondering, a bagholder is someone who keeps holding a losing stock indefinitely, without taking the time to consider its prospects carefully, going forward.

All else being equal, a share price drop should make a stock more attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that long term investors have an opportunity when expectations of a company are too low. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

Check out our latest analysis for HengTen Networks Group

Does HengTen Networks Group Have A Relatively High Or Low P/E For Its Industry?

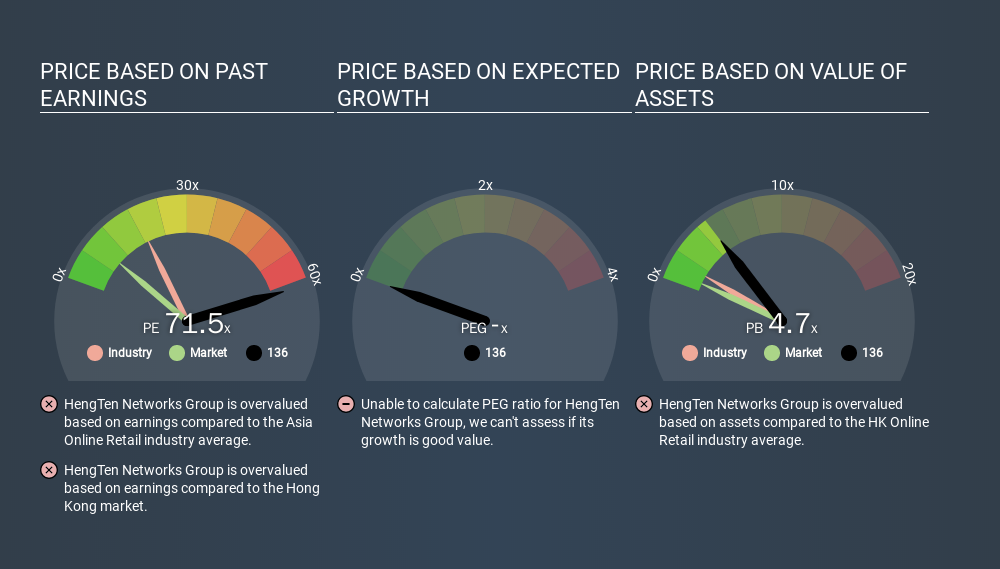

HengTen Networks Group's P/E of 64.25 indicates some degree of optimism towards the stock. As you can see below, HengTen Networks Group has a much higher P/E than the average company (18.0) in the online retail industry.

That means that the market expects HengTen Networks Group will outperform other companies in its industry. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

HengTen Networks Group shrunk earnings per share by 56% over the last year.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. That means it doesn't take debt or cash into account. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

How Does HengTen Networks Group's Debt Impact Its P/E Ratio?

HengTen Networks Group has net cash of CN¥1.1b. This is fairly high at 22% of its market capitalization. That might mean balance sheet strength is important to the business, but should also help push the P/E a bit higher than it would otherwise be.

The Bottom Line On HengTen Networks Group's P/E Ratio

With a P/E ratio of 64.3, HengTen Networks Group is expected to grow earnings very strongly in the years to come. Falling earnings per share is probably keeping traditional value investors away, but the net cash position means the company has time to improve: and the high P/E suggests the market thinks it will. What can be absolutely certain is that the market has become significantly less optimistic about HengTen Networks Group over the last month, with the P/E ratio falling from 97.3 back then to 64.3 today. For those who prefer to invest with the flow of momentum, that might be a bad sign, but for a contrarian, it may signal opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

You might be able to find a better buy than HengTen Networks Group. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of Mainland China, Hong Kong, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives