- India

- /

- Paper and Forestry Products

- /

- NSEI:GENUSPAPER

How Does Genus Paper & Boards' (NSE:GENUSPAPER) CEO Salary Compare to Peers?

Kailash Agarwal has been the CEO of Genus Paper & Boards Limited (NSE:GENUSPAPER) since 2013, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Genus Paper & Boards pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Genus Paper & Boards

How Does Total Compensation For Kailash Agarwal Compare With Other Companies In The Industry?

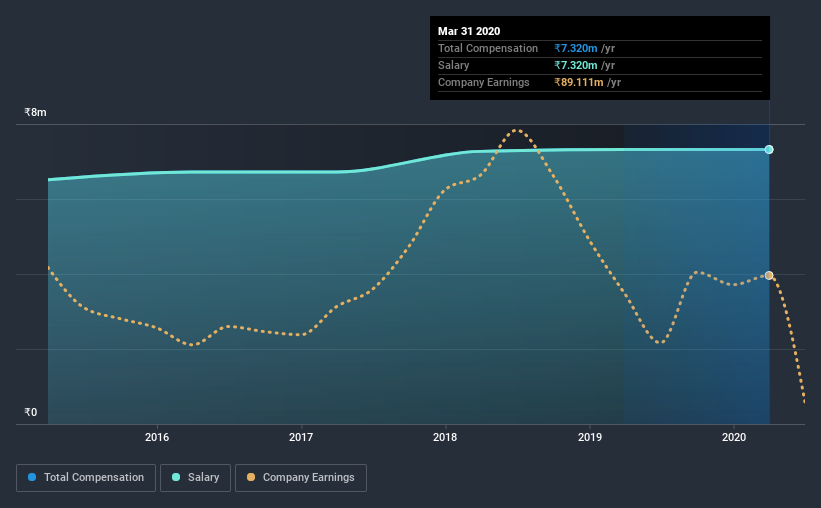

Our data indicates that Genus Paper & Boards Limited has a market capitalization of ₹1.3b, and total annual CEO compensation was reported as ₹7.3m for the year to March 2020. That's mostly flat as compared to the prior year's compensation. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹7.3m.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹7.8m. From this we gather that Kailash Agarwal is paid around the median for CEOs in the industry. Moreover, Kailash Agarwal also holds ₹76m worth of Genus Paper & Boards stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹7.3m | ₹7.3m | 100% |

| Other | - | - | - |

| Total Compensation | ₹7.3m | ₹7.3m | 100% |

On an industry level, roughly 89% of total compensation represents salary and 11% is other remuneration. Speaking on a company level, Genus Paper & Boards prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Genus Paper & Boards Limited's Growth

Over the last three years, Genus Paper & Boards Limited has shrunk its earnings per share by 37% per year. It saw its revenue drop 43% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Genus Paper & Boards Limited Been A Good Investment?

Since shareholders would have lost about 6.6% over three years, some Genus Paper & Boards Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Genus Paper & Boards pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we touched on above, Genus Paper & Boards Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, EPS growth and shareholder returns have been in the red for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 3 warning signs for Genus Paper & Boards that investors should be aware of in a dynamic business environment.

Switching gears from Genus Paper & Boards, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Genus Paper & Boards, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GENUSPAPER

Genus Paper & Boards

Primarily manufactures and sells kraft paper in India and internationally.

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives