How Does Clariant Chemicals (India)'s (NSE:CLNINDIA) CEO Salary Compare to Peers?

Adnan Ahmad has been the CEO of Clariant Chemicals (India) Limited (NSE:CLNINDIA) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Clariant Chemicals (India).

Check out our latest analysis for Clariant Chemicals (India)

How Does Total Compensation For Adnan Ahmad Compare With Other Companies In The Industry?

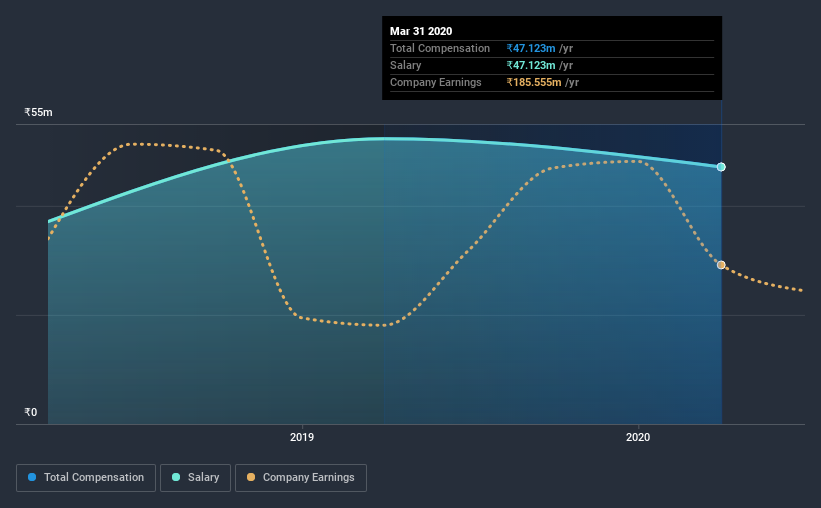

According to our data, Clariant Chemicals (India) Limited has a market capitalization of ₹9.0b, and paid its CEO total annual compensation worth ₹47m over the year to March 2020. We note that's a decrease of 9.9% compared to last year. Notably, the salary of ₹47m is the entirety of the CEO compensation.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹6.0m. This suggests that Adnan Ahmad is paid more than the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹47m | ₹52m | 100% |

| Other | - | - | - |

| Total Compensation | ₹47m | ₹52m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. Speaking on a company level, Clariant Chemicals (India) prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Clariant Chemicals (India) Limited's Growth Numbers

Clariant Chemicals (India) Limited has seen its earnings per share (EPS) increase by 20% a year over the past three years. In the last year, its revenue is down 36%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Clariant Chemicals (India) Limited Been A Good Investment?

Given the total shareholder loss of 3.8% over three years, many shareholders in Clariant Chemicals (India) Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

Clariant Chemicals (India) rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we noted earlier, Clariant Chemicals (India) pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, we must not forget that the EPS growth has been very strong, but it's disappointing to see negative shareholder returns over the same period. Although we don't think the CEO pay is too high, considering negative investor returns, it is more generous than modest.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for Clariant Chemicals (India) you should be aware of, and 1 of them shouldn't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Clariant Chemicals (India) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:HEUBACHIND

Sudarshan Colorants India

Engages in the manufacture and sale of specialty chemicals in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion