- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

How Does Bio-Techne's (NASDAQ:TECH) P/E Compare To Its Industry, After Its Big Share Price Gain?

Bio-Techne (NASDAQ:TECH) shareholders are no doubt pleased to see that the share price has had a great month, posting a 40% gain, recovering from prior weakness. And the full year gain of 39% isn't too shabby, either!

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

Check out our latest analysis for Bio-Techne

Does Bio-Techne Have A Relatively High Or Low P/E For Its Industry?

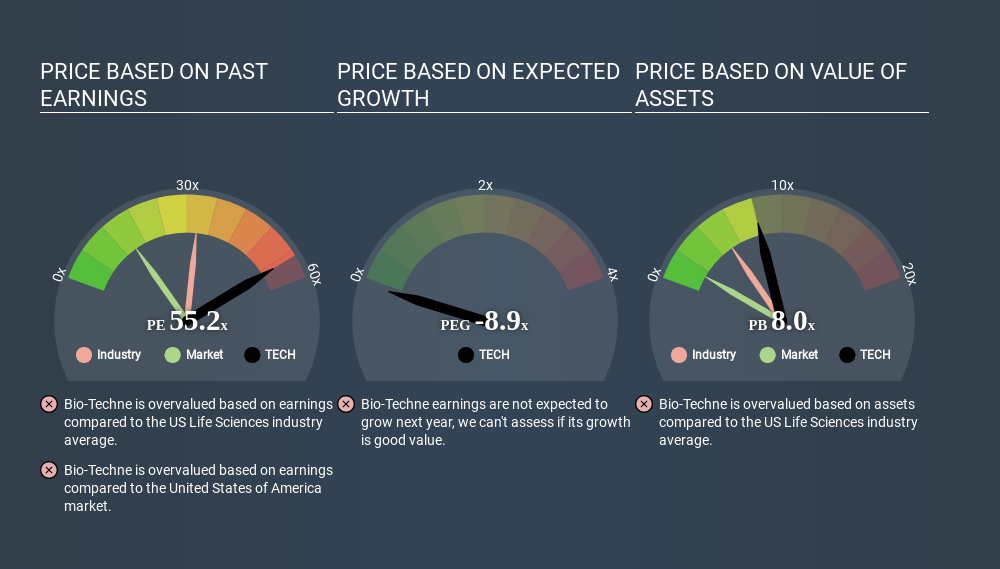

We can tell from its P/E ratio of 55.17 that there is some investor optimism about Bio-Techne. You can see in the image below that the average P/E (32.6) for companies in the life sciences industry is lower than Bio-Techne's P/E.

That means that the market expects Bio-Techne will outperform other companies in its industry. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Bio-Techne's 53% EPS improvement over the last year was like bamboo growth after rain; rapid and impressive. Even better, EPS is up 35% per year over three years. So we'd absolutely expect it to have a relatively high P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. In other words, it does not consider any debt or cash that the company may have on the balance sheet. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

How Does Bio-Techne's Debt Impact Its P/E Ratio?

Bio-Techne has net debt worth just 1.5% of its market capitalization. The market might award it a higher P/E ratio if it had net cash, but its unlikely this low level of net borrowing is having a big impact on the P/E multiple.

The Verdict On Bio-Techne's P/E Ratio

Bio-Techne's P/E is 55.2 which suggests the market is more focussed on the future opportunity rather than the current level of earnings. While the company does use modest debt, its recent earnings growth is superb. So to be frank we are not surprised it has a high P/E ratio. What is very clear is that the market has become significantly more optimistic about Bio-Techne over the last month, with the P/E ratio rising from 39.3 back then to 55.2 today. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors should be looking to buy stocks that the market is wrong about. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives