- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (HPE) Selected by Subaru for AI-Powered Safety Enhancements

Reviewed by Simply Wall St

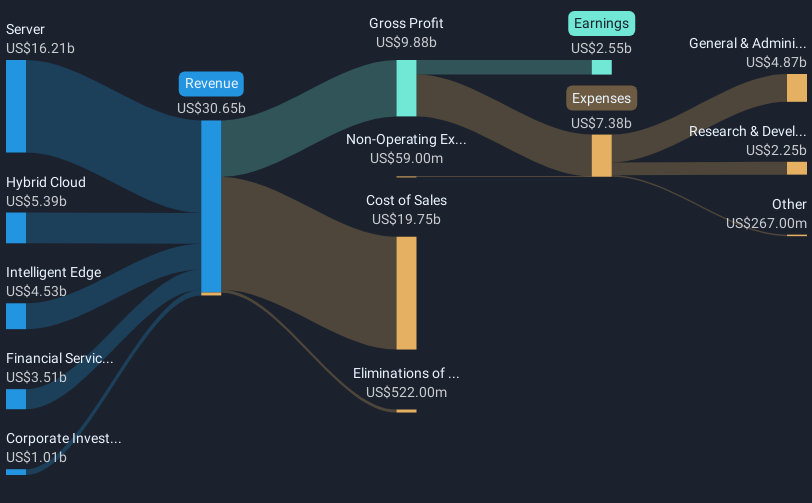

Hewlett Packard Enterprise (HPE) recently announced a collaboration with Subaru to integrate HPE Cray XD670 servers into its AI and image recognition technology, a move that aligns with broader industry trends towards AI and safety advancements in the automotive sector. During the last quarter, HPE's share price rose by 28%, reflecting positive sentiment influenced by key strategic initiatives, such as its enhanced partnerships and AI focus, amid a generally buoyant market that has seen the S&P 500 and Nasdaq reach new highs. HPE's activities, including partnerships and product launches, have added momentum to its share performance in line with broader market optimism.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent collaboration between Hewlett Packard Enterprise (HPE) and Subaru could reinforce HPE's focus on AI, potentially enhancing its revenue and earnings forecasts. By integrating HPE Cray XD670 servers into Subaru's AI and image recognition technology, there is an opportunity for significant advancement within the AI segment, aligning with HPE's existing GreenLake and AI workload capture strategies. Such collaborations could bolster HPE's efforts to capture high-margin offerings and improve net margins, which are critical for addressing existing competitive and regulatory challenges.

Over a five-year period, HPE's total shareholder return, including dividends, reached 147.52%. This impressive long-term performance contrasts with the company's relatively flat performance against the broader market over the past year, where it exceeded the US Tech industry but underperformed the overall US market, which showed a 17.7% return.

The recent share price increase could also impact perceptions relative to the analyst consensus price target. With current shares trading at US$20.88, the near-term price target of US$22.54 indicates an appreciation potential of approximately 9.4%. This suggests that the market still sees room for growth, especially as HPE continues to advance its AI and cloud strategies and addresses existing operational challenges. However, the alignment of these expected gains with forecasted revenue and earnings growth will play a crucial role in meeting or exceeding investor expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives