- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (HPE) Partners With Kyndryl To Enhance AI Cloud Solutions

Reviewed by Simply Wall St

Hewlett Packard Enterprise (HPE) recently expanded its global alliance with Kyndryl to bolster AI services through HPE Private Cloud AI, collaborating with NVIDIA to offer enterprise solutions. This announcement coincided with a 19% rise in the company’s stock over the last quarter, aligning with broader market gains characterized by rising indices like the S&P 500 and Nasdaq. HPE's strategic moves, such as its cooperation agreement with Elliott Investment Management and product-related developments, likely provided additional momentum to its share price increase alongside market trends encouraging AI and tech sector growth.

Find companies with promising cash flow potential yet trading below their fair value.

The recent news about Hewlett Packard Enterprise's collaboration with Kyndryl and NVIDIA, focusing on AI services, aligns with the company's ongoing strategy to bolster its AI and cloud capabilities. This partnership could enhance HPE's long-term revenue by leveraging high-margin AI workload opportunities. The news feeds into the narrative of HPE’s increased emphasis on AI and cloud technologies, which may drive higher earnings over time, especially if synergies from potential acquisitions like Juniper are successfully integrated. However, challenges such as regulatory hurdles and market competition remain.

Over the past five years, HPE’s total shareholder return was 132.75%, indicating strong long-term performance despite any short-term volatility. Nonetheless, over the past year, HPE underperformed the broader US market, which achieved a 22.4% return in that period. Compared to the US Tech industry, HPE excelled with a notable gain, surpassing the industry's minimal 0.6% return.

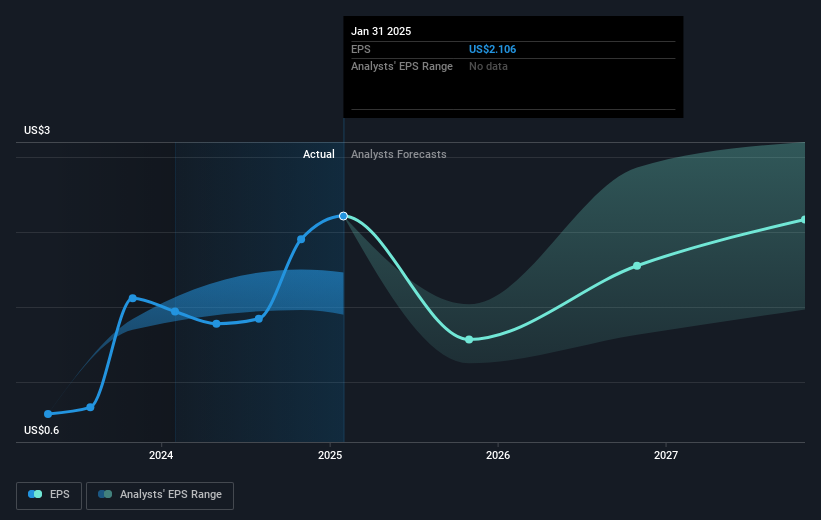

The current share price of US$20.13 remains below the consensus analyst price target of US$23.24, representing a discount of approximately 15.5%. While near-term stock movements might reflect the recent positive announcements, the market will likely continue to assess HPE’s ability to meet future revenue projections of around US$41.4 billion and earnings of US$4.1 billion by 2028. The lower current price suggests investor caution, possibly reflecting ongoing concerns about execution risks and regulatory challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives