Here's Why Zenith Exports (NSE:ZENITHEXPO) Might Be Better Off Without Debt

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies. Zenith Exports Limited (NSE:ZENITHEXPO) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Zenith Exports

How Much Debt Does Zenith Exports Carry?

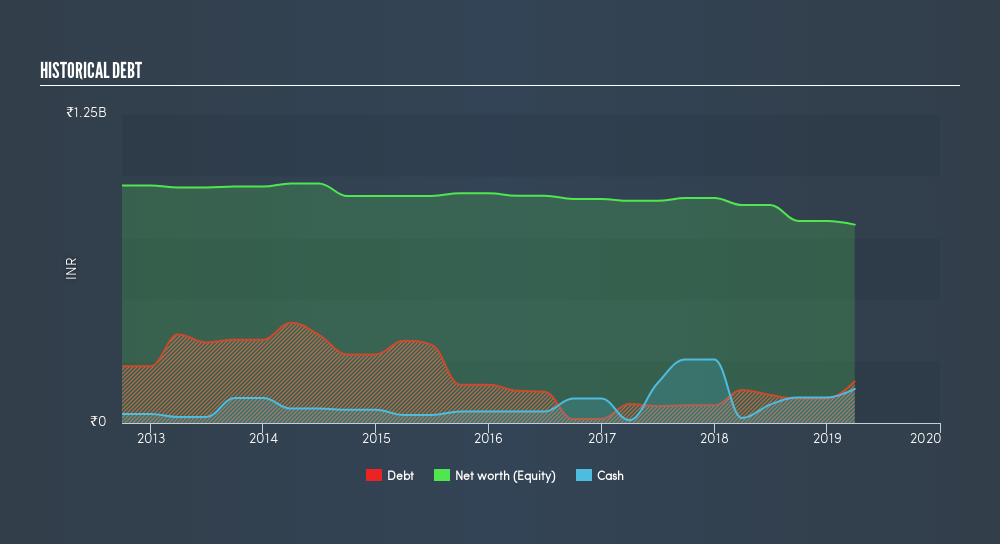

The image below, which you can click on for greater detail, shows that at March 2019 Zenith Exports had debt of ₹167.6m, up from ₹133.7m in one year. On the flip side, it has ₹138.4m in cash leading to net debt of about ₹29.2m.

How Strong Is Zenith Exports's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Zenith Exports had liabilities of ₹247.7m due within 12 months and liabilities of ₹25.2m due beyond that. Offsetting this, it had ₹138.4m in cash and ₹144.4m in receivables that were due within 12 months. So it actually has ₹9.90m more liquid assets than total liabilities.

This surplus suggests that Zenith Exports has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Either way, since Zenith Exports does have more debt than cash, it's worth keeping an eye on its balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Zenith Exports will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Zenith Exports saw its revenue drop to ₹986m, which is a fall of 10.0%. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Zenith Exports produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping ₹43m. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. But we'd be more likely to spend time trying to understand the stock if the company made a profit. So it seems too risky for our taste. For riskier companies like Zenith Exports I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ZENITHEXPO

Zenith Exports

Engages in the leather goods and textile fabrics businesses for the home and apparel industries in India and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives