Here's Why We Don't Think Tre Kronor Property Investment's (STO:3KR) Statutory Earnings Reflect Its Underlying Earnings Potential

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Tre Kronor Property Investment (STO:3KR).

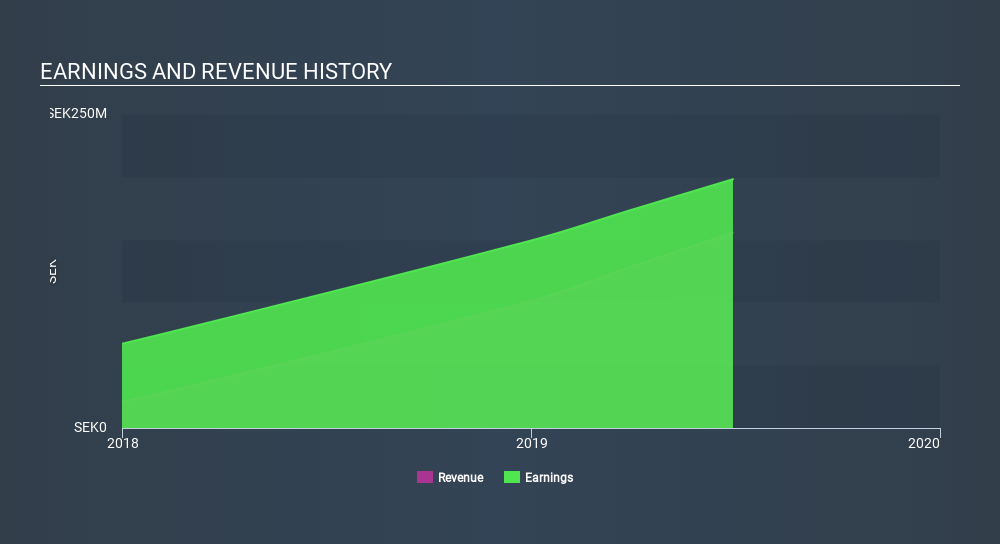

While Tre Kronor Property Investment was able to generate revenue of kr155.7m in the last twelve months, we think its profit result of kr198.0m was more important.

See our latest analysis for Tre Kronor Property Investment

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. In this article we'll look at how Tre Kronor Property Investment is impacting shareholders by issuing new shares, as well as how unusual items have affected the income line. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Tre Kronor Property Investment.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Tre Kronor Property Investment expanded the number of shares on issue by 78% over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Tre Kronor Property Investment's EPS by clicking here.

A Look At The Impact Of Tre Kronor Property Investment's Dilution on Its Earnings Per Share (EPS).

We don't have any data on the company's profits from three years ago. The good news is that profit was up 84% in the last twelve months. But EPS was far less impressive, dropping in that time. This shows how dangerous it is to rely on net income alone, when measuring growth. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if Tre Kronor Property Investment's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Tre Kronor Property Investment's profit was boosted by unusual items worth kr194m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. We can see that Tre Kronor Property Investment's positive unusual items were quite significant relative to its profit in the year to June 2019. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Tre Kronor Property Investment's Profit Performance

To sum it all up, Tre Kronor Property Investment got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. On reflection, the above-mentioned factors give us the strong impression that Tre Kronor Property Investment's underlying earnings power is not as good as it might seem, based on the statutory profit numbers. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. If you're interestedwe have a graphic representation of Tre Kronor Property Investment's balance sheet.

Our examination of Tre Kronor Property Investment has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives