Here's Why We Don't Think Deutsche Post's (ETR:DPW) Statutory Earnings Reflect Its Underlying Earnings Potential

Broadly speaking, profitable businesses are less risky than unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Deutsche Post (ETR:DPW).

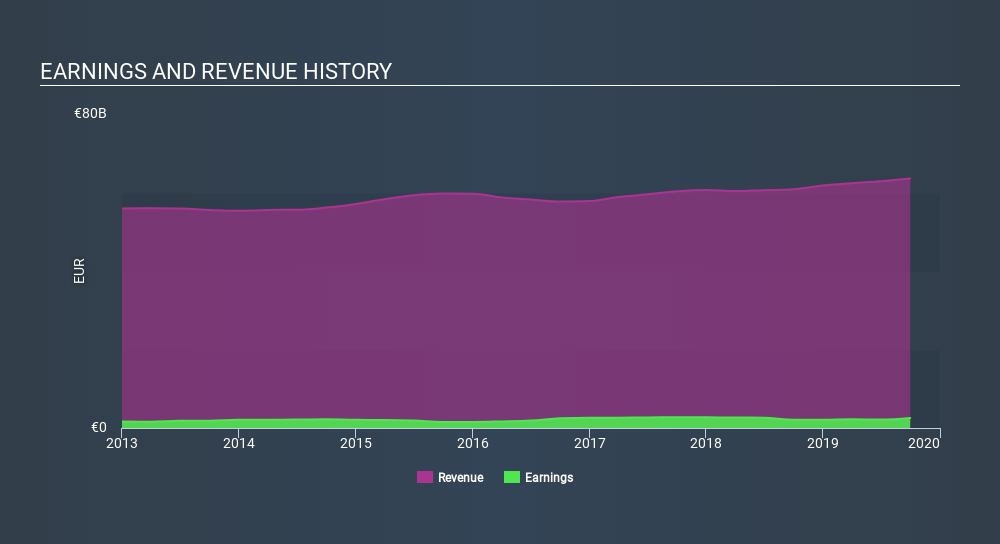

We like the fact that Deutsche Post made a profit of €2.58b on its revenue of €63.5b, in the last year. One positive is that it has grown both its profit and its revenue, over the last few years.

View our latest analysis for Deutsche Post

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will discuss how unusual items have impacted Deutsche Post's most recent profit results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

To properly understand Deutsche Post's profit results, we need to consider the €621m gain attributed to unusual items. We can't deny that higher profits generally leave us optmistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Deutsche Post doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Deutsche Post's Profit Performance

Arguably, Deutsche Post's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Deutsche Post's true underlying earnings power is actually less than its statutory profit. The good news is that, its earnings per share increased by 22% in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. While it's really important to consider how well a company's statutory earnings represent its true earnings power, it's also worth taking a look at what analysts are forecasting for the future. At Simply Wall St, we have analyst estimates which you can view by clicking here.

This note has only looked at a single factor that sheds light on the nature of Deutsche Post's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:DHL

Deutsche Post

Operates as a mail and logistics company in Germany, rest of Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion