Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Mowi ASA (OB:MOWI) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Mowi

What Is Mowi's Debt?

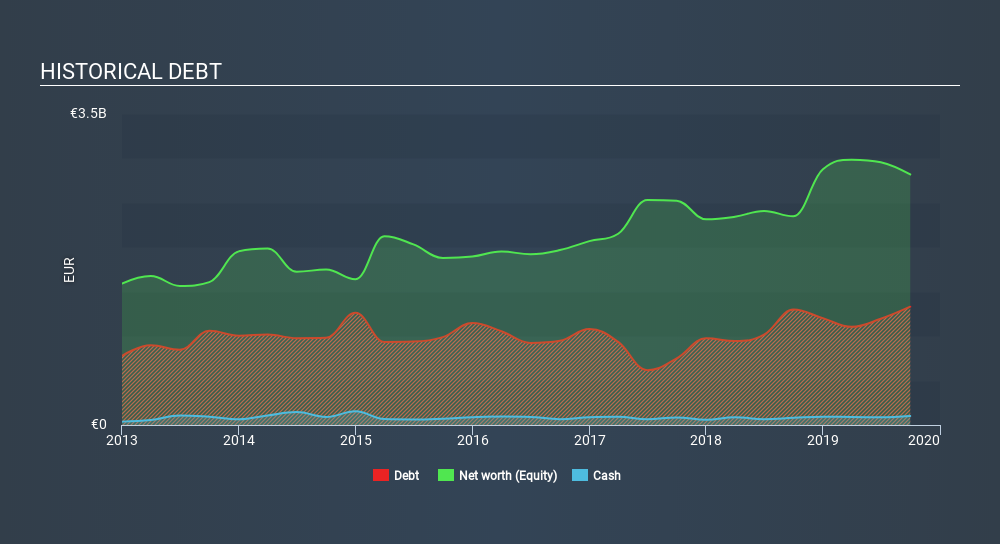

The chart below, which you can click on for greater detail, shows that Mowi had €1.33b in debt in September 2019; about the same as the year before. However, because it has a cash reserve of €101.2m, its net debt is less, at about €1.23b.

How Healthy Is Mowi's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Mowi had liabilities of €859.9m due within 12 months and liabilities of €2.01b due beyond that. On the other hand, it had cash of €101.2m and €604.5m worth of receivables due within a year. So it has liabilities totalling €2.17b more than its cash and near-term receivables, combined.

Of course, Mowi has a titanic market capitalization of €11.5b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Mowi has a low net debt to EBITDA ratio of only 1.4. And its EBIT covers its interest expense a whopping 11.7 times over. So we're pretty relaxed about its super-conservative use of debt. But the bad news is that Mowi has seen its EBIT plunge 19% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Mowi can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Mowi's free cash flow amounted to 47% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mowi's EBIT growth rate and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. Looking at all the angles mentioned above, it does seem to us that Mowi is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Given our hesitation about the stock, it would be good to know if Mowi insiders have sold any shares recently. You click here to find out if insiders have sold recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OB:MOWI

Mowi

A seafood company, produces and sells Atlantic salmon products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives