- United States

- /

- Banks

- /

- NasdaqGS:INBK

Here's Why I Think First Internet Bancorp (NASDAQ:INBK) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like First Internet Bancorp (NASDAQ:INBK), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for First Internet Bancorp

How Fast Is First Internet Bancorp Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Over twelve months, First Internet Bancorp increased its EPS from US$2.31 to US$2.51. That amounts to a small improvement of 8.9%.

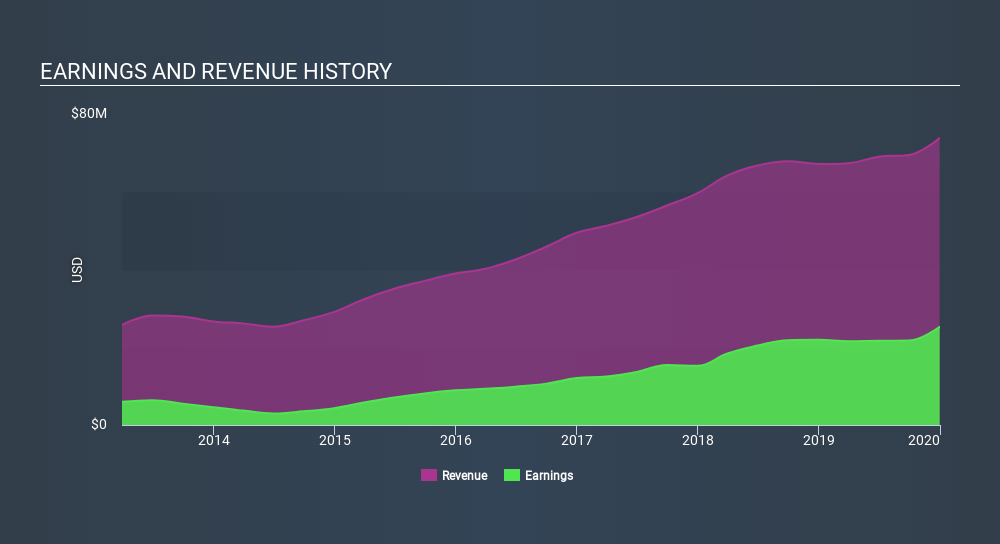

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that First Internet Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note First Internet Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 9.9% to US$74m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of First Internet Bancorp's forecast profits?

Are First Internet Bancorp Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling First Internet Bancorp shares, in the last year. With that in mind, it's heartening that Jerry Williams, the Independent Director of the company, paid US$21k for shares at around US$21.11 each.

Along with the insider buying, another encouraging sign for First Internet Bancorp is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$13m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 4.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is First Internet Bancorp Worth Keeping An Eye On?

As I already mentioned, First Internet Bancorp is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of First Internet Bancorp. You might benefit from giving it a glance today.

As a growth investor I do like to see insider buying. But First Internet Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:INBK

First Internet Bancorp

Operates as the bank holding company for First Internet Bank of Indiana that provides various commercial, small business, consumer, and municipal banking products and services to individuals and commercial customers in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives