Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that GAIL (India) Limited (NSE:GAIL) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for GAIL (India)

What Is GAIL (India)'s Debt?

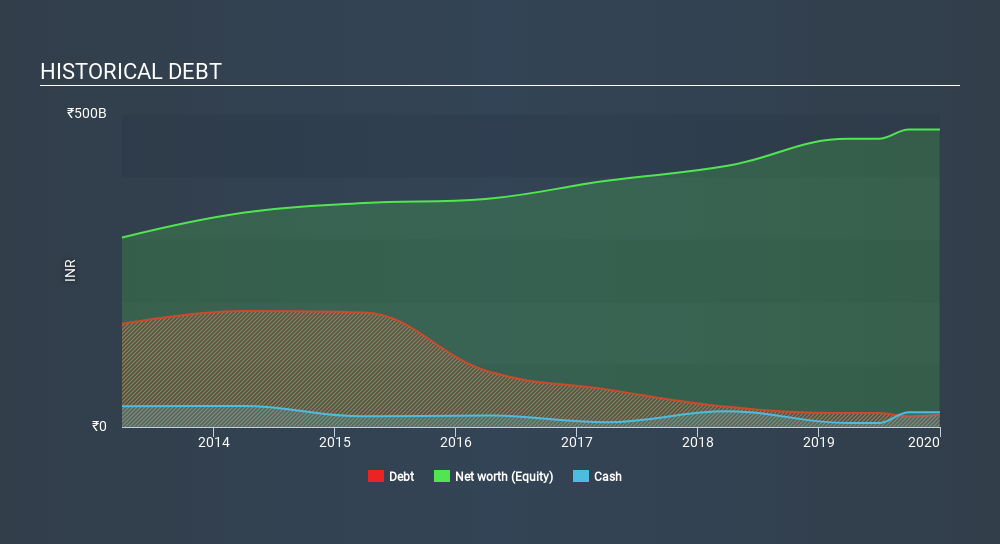

As you can see below, GAIL (India) had ₹16.8b of debt at September 2019, down from ₹22.2b a year prior. But it also has ₹23.5b in cash to offset that, meaning it has ₹6.67b net cash.

How Healthy Is GAIL (India)'s Balance Sheet?

According to the last reported balance sheet, GAIL (India) had liabilities of ₹103.2b due within 12 months, and liabilities of ₹124.3b due beyond 12 months. Offsetting these obligations, it had cash of ₹23.5b as well as receivables valued at ₹59.2b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹144.8b.

This deficit isn't so bad because GAIL (India) is worth ₹329.7b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Despite its noteworthy liabilities, GAIL (India) boasts net cash, so it's fair to say it does not have a heavy debt load!

But the bad news is that GAIL (India) has seen its EBIT plunge 19% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if GAIL (India) can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. GAIL (India) may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, GAIL (India)'s free cash flow amounted to 39% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While GAIL (India) does have more liabilities than liquid assets, it also has net cash of ₹6.67b. So although we see some areas for improvement, we're not too worried about GAIL (India)'s balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - GAIL (India) has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:GAIL

GAIL (India)

Operates as a natural gas processing and distribution company in India and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives